2022 has been a historic year in many ways. Still recovering from post-pandemic supply/demand imbalances, the global landscape shifted dramatically in February when Russia invaded Ukraine. Accelerating global inflation followed, spurring aggressive shifts in central bank policy. The U.S. Federal Reserve has raised interest rates this year at a faster pace than any time in recorded history. Markets for both stocks and bonds are set to deliver double digit negative returns in a calendar year for the first time since the major indices were formed.

Looking at the data, one might conclude this was an unusual year for markets. Taking a step back, we argue that while the pace and magnitude of the events of 2022 were historic, the market environment over the previous decade was more unusual.

In this letter, Pathstone’s Chief Investment Office will examine the outlook for markets and the economy and how investors should think about the navigating a bumpy road back to a more “normal” environment of elevated interest rates, credit spreads, and subdued equity valuations. We will offer our insights on how the macro environment unveils opportunities and risks across liquid and private markets that we have not seen in the prior 13+ years of artificially low interest rates. While we believe there will be further bumps and twists in the road in 2023, successful long-term investors will be prepared to look out for on-ramps to the highway where opportunities for smoother returns will emerge.

—Alex Hart, CFA, Executive Managing Director, Chief Investment Office

Table of Contents

- Investment Strategy Without Training Wheels

- Global Equities – Tuning Up for a Road Trip

- Alternatives – A Regime Shift from Macro to Micro

- Private Markets – Private Investments Dampen Shocks

- Portfolio Management Strategies – Autopilot Not Ready Yet

Investment Strategy Without Training Wheels

John Workman | Managing Director, Investment Strategy

2022 marked a change in the global economic road. Central banks globally have removed emergency level interest rates as inflationary pressures have forced their hands. Beyond increasing interest rates, the world’s major central banks (U.S. Fed, European Central Bank, Bank of Japan, and Bank of China) have been collectively shrinking their balance sheets as well. Together they hold $27.6 trillion of assets as of October 2022 after topping $31 trillion at their peak.

We are no longer on freshly paved highway and the guardrails are no more. Investors will be forced to recalibrate risk and return expectations as we enter 2023. They will have to look back more than 14 years to recall what “normal” looks like. Low inflation, 0% interest rates, and quantitative easing have served as a tailwind for financial assets since the Global Financial Crisis, except for the period from December 2015 to July 2019 when the Fed tried to unwind its emergency measures before finding it necessary to reverse course because of weak global growth and trade tensions between the U.S. and China. The pandemic in 2020 forced central banks to return to emergency measures once again. It is no wonder that many market participants anticipate that Fed tightening may soon be reversed.

Will U.S. Headwinds Favor non-U.S. Equity Markets?

Considering this environment and the setbacks that both equities and bonds have faced in 2022, what should we expect in 2023? Our Market Cycle Dashboard readings continue to suggest that there is a heightened risk of recession. Our fundamental analysis tells us that the U.S. is likely to experience some headwinds to corporate profits resulting from higher input costs (particularly labor), higher cost of capital and higher taxes (15% minimum corporate tax and 1% tax on buybacks). European markets face challenges around inflation and energy supplies, while China faces challenges from over-leverage in real estate markets and still-encumbered economic activity due to COVID policies, though both pressures seem to be easing. Foreign investment in China has been reduced as fears of an imminent takeover of Taiwan persist. Both European and Asian equity markets are more attractively valued as a result, and after an extended period of strength in the U.S. dollar, may enjoy some currency tailwinds. Our Capital Market Assumptions suggest that better-than-average returns may be available in non-U.S. equity markets in the years ahead, with the caveat that things could still get cheaper should a recession hit. U.S. equity markets still trade at a premium relative to other developed and emerging markets, perhaps from the perspective that the U.S. may be in better economic shape.

Fixed Income Looking More Promising

As part of the reassessment that investors make in 2023, one benefit will be higher starting yields. After a miserable year for fixed income investors in 2022, the set-up for better return expectations in 2023 is in. Short and Intermediate bonds are offering the most attractive entry point for investors in nearly two decades. As allocation decisions are made, higher yields will be welcomed, but this will also create a need to re-evaluate the trade-off in relative returns across asset classes, as riskier assets will need to provide higher expected returns in the years ahead to gain investors’ attention.

Overall, Proceeding with Caution

We enter 2023 with a cautious positioning of portfolios, recognizing that near-term risks may not be fully priced into equity markets—particularly considering the more attractive alternatives that investment grade fixed income offers today. We continue to believe that we are nearing the later stages of the business cycle as interest rates are pushed to new highs and pandemic stimulus wears off. While a soft landing would be welcomed, it is not our base case. In preparation, we are revisiting our playbook for the early cycle, recognizing that markets typically begin to move higher before all the dust has settled. As we approach the new year, we continue to work diligently to explore the opportunities that are developing, and we remain mindful of the risks and how the markets are pricing them. We are privileged to have your trust and look forward to helping you achieve your wealth goals in the years ahead with thoughtful analysis and humble attitudes.

Global Equities – Tuning Up for a Road Trip

Donna Szeto, CFA | Director, Long-Only Research

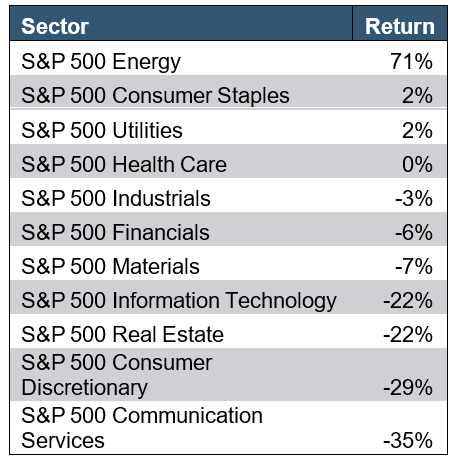

In U.S. dollar terms, all public equity markets are looking to post double-digit negative returns for 2022, something not seen since the Global Financial Crisis in 2008. Currency, specifically a strong U.S. dollar, had a significant impact to returns for U.S.-based investors both directly, with foreign exchange translation eroding local market returns from non-U.S. markets, and indirectly, with large U.S.-based global companies seeing international revenues hit by the foreign exchange conversion. Further, equity markets have been volatile, fueled by the war in Ukraine, rising interest rates, and rising inflation. From a sector perspective, other than Energy being turbocharged, remaining sectors either stalled around zero or had their gears in reverse:

Returns through 11/30/22

Diversified active managers faced headwinds from indiscriminate selling in the markets. This was particularly tough for growth-oriented managers, as multiples compressed more significantly in traditional growth sectors where valuations are higher. In contrast, managers with quality and value factors fared better but still had a deficit to make up if they were underweight Energy. The quality factor was particularly helpful for active U.S. small-cap managers benchmarked against the Russell small cap indices, where 40% of constituents comprise unprofitable companies, most of which significantly sold off this year.

In an environment where investors were dumping stocks, we observed active managers were busy taking advantage of the sales the market presented to them. For managers with dry powder, we saw them reduce the cash in the portfolio. Other managers took the opportunity to upgrade the quality of their portfolio. In all cases, the message was the same: high-quality companies on their watch lists, which were too expensive to own previously, now became attractive on valuations. Underlying purchases differed by manager, but examples of some of these quality purchases are mega-cap growth companies and multinational European companies. As the bumpiness continues in the markets, we believe these quality companies should provide some level of resiliency to absorb the shocks.

Looking ahead, we believe a higher interest rate environment will create differentiation and dispersion among company level outcomes. Those companies that are more highly levered with weak competitive advantages may be exposed as costs of refinancing debt rise. Similarly, companies that have failed to make a profit will be pressured to execute their business strategies and demonstrate financial discipline as the equity markets can no longer be counted on for dependable, easy financing. This could present further challenges to more speculative sectors like biotech. The impact is likely to continue to play out more significantly within smaller-capitalization stocks where leverage rates are higher and unprofitability is more common. As noted above, 40% of companies in the Russell 2000 Index failed to make a profit in the trailing 12 months[1]. If this number accelerates, we expect active managers that favor higher-quality businesses to be positioned as attractive alternatives to passive index exposure.

[1] As measured by trailing 12-month net income as of 11/31/22. Source: Morningstar Direct.

Alternatives – A Regime Shift from Macro to Micro

Chris Martin, CFA, CAIA | Director, Alternatives Research

2022 began with the best quarter for macro hedge funds[2] in the last 20 years[3]. The dispersion between asset classes – equities negative, credit negative, commodities positive, interest rates higher, dollar higher — provided a rich opportunity set for these strategies and they largely delivered. While macro funds were ahead of many of these moves, the fastest-ever increase in short-term interest rates from the U.S. Federal Reserve led to high volatility across and within asset classes, which relative value funds can drive performance from for years to come. The increase in interest rates also provides opportunities for liquid and illiquid credit managers as both nominal and real yields get more attractive. We wrote in our 2021 year-end letter, “it was a great year for alternatives, and the opportunity set only appears to be improving into 2022.” Looking ahead, we believe the opportunity set might be even better in 2023.

The HFRI Macro Index (+8.15%[4]) and HFRI Relative Value Index (-0.84%[5]) led performance for 2022, showing strength across all subcategories, from systematic macro funds such as CTAs/trend-followers to pure discretionary strategies. While the strategies in the macro category can differ widely, the significant moves across markets in 2022 provided ample opportunity for these strategies to either get ahead of or get behind, depending on their orientation. Overall, Macro funds are delivering levels of performance not seen since prior to the financial crisis in 2008.

While we believe the landscape for these funds continues to look attractive, we believe other areas of the hedge fund landscape, such as credit and relative value, have developing opportunity sets that likely deserve an increased focus. Relative value funds try to capture temporary dislocations in pricing between securities or asset classes. Persistent high volatility and increased dispersion between securities caused by a rapid increase in interest rates have provided a significant increase in the occurrence of these temporary dislocations. With rates likely to remain high or rise further in 2023, we believe these occurrences are likely to continue.

Source — Hedge Fund Research

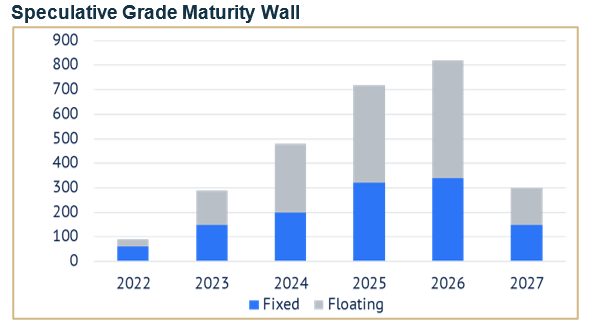

On the credit front, increased interest rates designed to slow economic growth can prove a disastrous combination for companies that are not properly prepared, particularly those that may have overborrowed in the preceding era of ultra-low interest rates. If this leads to an increase in bankruptcies, or near-bankruptcies, across the corporate market, both liquid and distressed credit managers could see opportunities for returns largely not available since the Global Financial Crisis. Additionally, the increase in mortgage rates has already led to a re-rating in the mortgage-backed security market. While some of these securities likely deserve to be re-rated, many of them contain underlying loans that are well-seasoned and have very low loan-to-value ratios. We have existing relationships with experienced investors in corporate and mortgage-backed markets and are prepared to allocate additional capital to them as these opportunities unfold.

Along the same lines as some of the dislocations described above, the closed-end fund market has experienced widening discounts in 2022 as investor sentiment has turned sour. While the closed-end fund strategies on our platform were conservatively positioned for just this scenario, we have begun to see the universe open up and provide opportunities to invest in funds with wider discounts and higher yields, a combination that has historically provided very attractive forward-looking returns.

With flexible mandates and more stable capital bases, bumpy roads are where alternatives shine. 2022 was a great example of this, but our macro forecast calls for additional bumps in 2023. We continue to believe investors who partner with thoughtful and experienced alternative managers can add value relative to a conventional 60/40 portfolio in the years to come.

[2] A macro hedge fund is a broad label that encompasses many different approaches to investing through a macroeconomic lens.

[3] Hedge Fund Research, HFRI Macro Index (Total)

[4] Hedge Fund Research, HFRI Macro Index (Total)

[5] Hedge Fund Research, HFRI Relative Value Index (Total)

Private Markets – Private Investments Dampen Shocks

Katie Robinette, CFA | Director, Private Markets Research

Private Equity

Private equity markets began 2022 on the heels of the fastest pace of deal and exit activity in at least two decades, as well as their best returns on record, driven by cheap and abundant debt and one of the most active IPO markets since early 2000. Despite the market volatility we have experienced in 2022, we are just beginning to see a resetting of valuations for private equity, and performance has been strong versus public equities. Venture capital, however, has experienced more pronounced declines in valuations and exit activity with an IPO market that has all but shut for venture-backed companies.

Going forward, we expect to see more significant valuation declines across the board, slower fundraising and deal activity, and a continued slowdown in exit activity as investors and sellers adjust to an environment of higher inflation and interest rates, diminished availability of capital, and potential geopolitical risks. Relative to past cycles, we have observed increasingly pervasive use of lines of credit for bridging capital calls and even to implement leverage at the Fund level. In a zero-rate environment with upwardly trending valuations, these lines could be used to reduce or even eliminate the conventional “J-curve” effect in recent years. As rates rise, we continue to be mindful of this trend and the risks it presents in terms of increased fees, performance distortions, and even possible defaults. Although this environment will be more challenging for private equity than the last decade, we think it will also present an attractive investment opportunity set for experienced and disciplined managers.

Historically, private equity has produced superior relative returns throughout market cycles. Over the past 20 years, it has outperformed the Russell 3000 and MSCI World by 5% and 7%, respectively.[6] Environments of uncertainty and volatility play particularly well to private equity’s strengths. The ability to control timing of commitment deployment, a value-add approach and operational capabilities, access to a stable pool of capital, and control over exit timing are all reasons that contribute to the long-term success of the asset class, and they become especially important in environments like the one we are in today. However, the range of possible outcomes for the asset class far exceeds the public markets, making manager selection and diversification even more critical (see chart). We continue to believe that seasoned managers with a true value-add approach that are prepared and equipped to respond quickly will be well positioned to capitalize on opportunities in the coming years.

Source — Burgiss; Private Markets returns are peer group medians of pooled 10-year annualized IRRs provided by Burgiss and are as of 6/30/22.

Going forward, we think there will be opportunity in events like corporate carve-outs, where companies are seeking solution capital to restructure their organizations through divestments of non-core businesses. Although these are usually leveraged transactions that will be impacted by higher rates, the impact can be mitigated by lower valuations, a value-add thesis, and creative and better structuring terms. Also, add-on opportunities should remain an attractive source of value as they are less tied to public market multiples and allow platform companies to buy up smaller companies to increase scale or product set and reduce buy-in prices. More opportunistic strategies like distressed debt and secondaries that can provide capital to companies or investors with liquidity challenges can also become highly attractive in periods of dislocation.

There continues to be a compelling opportunity set for growth equity (expansion capital) and venture capital strategies that target sectors with long-term tailwinds and high potential growth like fintech, healthcare technology, cybersecurity, life sciences, and data analytics. We think growth equity could be particularly appealing because of more rapid scaling, breakeven economics, a stronger capital base and little use of leverage. Smaller, earlier stage venture capital companies are riskier investments and could be more impacted by longer hold periods and the ability to secure follow-on financing. Therefore, manager selection will be even more critical to successfully access that opportunity set.

Private Real Estate

Private real estate investors started the year where they left off in 2021, with continued gains. However, as inflation ran high and rates increased, returns moderated and transactions slowed. Investors question the impact of higher borrowing costs and where cap rates may settle as Treasury rates move up. The expected economic slowdown also contributes to this uncertainty as managers assess which sectors and markets will continue to perform and which will experience greater pricing pressure.

Apartment rent growth over the last year has offset much of the rate impact, providing stability for this resilient sector, though rents have recently softened in markets that saw the highest growth. Wage growth has kept apartments affordable and overall fundamentals remain solid. Occupancies continue to run in the mid-90% area. Also, higher mortgage rates may be deterring a meaningful shift to home ownership.

Long-term industrial trends, especially e-commerce, drive tenant demand for the industrial real estate sector as companies rethink supply chain solutions and space needs for better inventory management. Demand for larger distribution buildings may slow in the short term, yet smaller industrial buildings close to urban centers are critical infrastructure. Companies seek close-in locations to manage their total costs and shorten delivery times.

Hotel and retail properties have experienced a dramatic turnaround from the depths of 2020. Loan defaults across this group have fallen for 10 consecutive quarters since the peak of June 2020. The 30-day delinquency rate for commercial mortgage-backed security loans improved to 4.9% for hotels (from 24.3%) and 6.6% for retail (from 18.1%). These Covid-hit sectors have built a strong base for a recovery and have a more balanced profile compared to one year ago.

Office has replaced retail as the sector to watch. Although office tenant credit quality remains high, pockets of pain have emerged for lower-quality buildings and harder-hit downtown areas. As leases roll over, businesses increasingly target newer buildings, leaving owners with older Class B (or less) space fighting to maintain longer-term occupancy without dropping rents significantly. Also, lenders hesitate to make loans backed by older office stock, putting additional pressure on the space.

Private Income & Credit

The private credit market has grown substantially over the past decade on the back of robust M&A activity and a conducive environment for companies to add leverage to their balance sheets. Stable and impressive returns have followed. Amid record low rates in 2021, we expanded our definition of private credit to include diversifying private income assets in real estate debt and other specialty finance strategies. We were concerned that traditional private credit and private equity strategies carried a common economic risk factor: exposure to leveraged corporate balance sheets. By diversifying into other assets, we expected to create a return profile more insulated from potential economic recession and the associated credit default cycle. While we have yet to see this cycle play out, listed equity and credit markets have sold off in 2022 while each of these sub asset classes has demonstrated strong performance throughout the year.

Looking ahead, we believe private income assets remain well positioned but diversification and manager selection will remain key to success. The direct lending portfolio should be insulated against the impacts of inflation and rising rates due to the first lien, senior secured, floating rate nature of the underlying loans. At the same time, default rates in corporate credit could pick up as companies face rising interest costs and a more challenging refinancing environment. We continue to prefer lenders with diversified approaches to lending to private equity backed companies where active owners can pull levers to manage through tough environments. These characteristics can produce results that demonstrate stability relative to investment grade and liquid high yield debt.

Source — Pitchbook, Data Estimated (Top) – As of 6/30/22; S&P, Apollo Chief Economist – Data as of 7/1/22.

Portfolio Management Strategies – Autopilot Not Ready Yet

Sarb Shah | Managing Director, Investment Research

Market cycle transitions present opportunities to assess the basis for investment returns of the previous cycle and consider why the factors driving returns may differ during the next regime. Underpinning those reflections are two clear beliefs: 1) normalizing to higher interest rates after years of monetary intervention impacts the broader economic outlook; and 2) 2023 will be a period where the earnings test will be front and center after a year characterized primarily by valuation stress. As our team develops conviction around the depth and duration of an economic and market downturn, we know the next 12 to 24 months will present portfolio risks and opportunities consistent with a change in the monetary environment and transition to the early cycle.

Our team leaders have presented a wide range of considerations across their respective focus areas. On the macroeconomic front, the 2023 picture is foggy as an extremely aggressive rate-hiking cycle remains in its early stages. Within Liquid Equities and Credit, we conclude that the valuation reset experienced in 2022 was more a function of higher interest rates and less the result of a broad economic and earnings downturn. Our Equity and Credit Risk Alternatives team is cautiously optimistic that structurally higher rates mean higher dispersion — a backdrop that should present more opportunity for security selection and idiosyncratic, situational investing. Lastly, the Private Markets team believes that a difficult exit environment and declining valuations in private equity demand an even greater illiquidity premium, while cash flows for Private Income strategies should remain resilient barring a significant economic retrenchment. Below are a few considerations for portfolios with that backdrop in mind.

Liquid Markets

Preparation for the early cycle playbook. We know that financial markets are a series of probability-adjusting machines that collectively reflect today what the environment will be and generally not what it is. While processing the impact of ongoing global monetary adjustment, we are preparing for an incremental increase in portfolio risk in the areas of credit, U.S. small cap, and non-U.S. equities – what we commonly refer to as the early cycle playbook. The most likely trigger to initiate this implementation recommendation is the widening of credit spreads, something that will increase the chance of a policy change by the Fed and signal the break in demand that the current monetary policy framework seeks to accomplish. Cycles generally do not turn without a corporate or household balance sheet reset. Within this playbook, we highlight that the credit quality of the high-yield market has improved relative to the loan market, that there is increasing latent demand for U.S. housing, and that non-U.S. exporters could benefit from unique tailwinds driven by shifting geopolitics and dollar weakness that usually coincides with peak hawkishness on behalf of the Fed. We also are reminded that quantitative easing (QE) drove capital flows into the U.S. disproportionately – support that is waning as the Fed decreases its balance sheet.

Better environment for active investing. Increases in the cost of capital should further separate good companies from ordinary ones. Just as years of low rates led to the tremendous growth and outperformance of passive investing, we think that a higher rate environment creates a stronger playing field for security selection within equities and credit. While passive exposure should remain a core part of a fee- and tax-efficient portfolio, high-conviction strategies, including concentrated mutual funds, event-driven strategies, and certain types of equity long/short hedge fund structures, could enhance what has otherwise been a difficult 10-year environment for active investing performance.

Reshuffling of market leadership. Each cycle brings a change in leadership for the markets. As we speak to our active managers, we are looking for teams that understand the conditioning of the market and do not sit complacently with portfolios full of the winners of the last ten years. This is especially true for growth-oriented managers. Many sectors were heavily overcapitalized during the QE period and could face years of rightsizing, much like during the 2001-03 timeframe. Furthermore, we cite clear evidence from 2022 that higher rates mean less indiscriminate support for long-duration equities like growth stocks. As a result, a technology overweight within passive portfolios should be reviewed against a more balanced expression of growth and value factors.

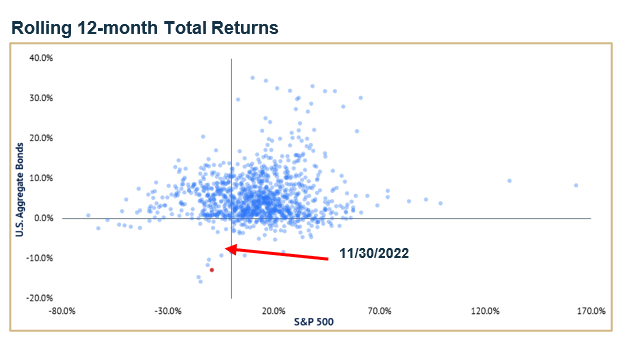

Source — Bloomberg. Barclays US Aggregate Bond (backfilled with IA SBBI US IT Govt).

Stock-bond correlations to normalize. 2022 has been a historically bad year for diversified portfolios because of a breakdown in traditional equity and fixed income correlation (red dot in this chart). Historically, traditional fixed income markets have not experienced consecutive periods of negative returns. Savers have not been rewarded during the QE regime, and we believe this is in the process of changing.

Illiquid Markets

Return of illiquidity premium. Banks are retrenching. The IPO market is shut. Outstanding commitments to private capital are too high relative to the pace of distributions. As central banks work to extract liquidity, we believe outsized returns will be generated by providers of liquidity when it is scarce. We see this currently occurring in private credit markets as high-quality companies or assets need capital solutions to correct bad capital structures or to finish development projects, in the case of real estate. We expect the cost of capital for these solutions to come at a significant premium to their liquid benchmarks. In private equity, we are seeing a sharp valuation correction in markets with elevated financing risk, such as growth and venture capital, and are starting to see operating pressures from debt service negatively impact highly levered buyouts. This dynamic should improve the returns for upcoming private credit and equity vintages, and we encourage portfolios to create liquidity from lower-returning asset classes to fund them.

Special situations in real estate. In the search for yield, investors pushed real estate cap rates to historic lows in early 2022, especially in the multifamily housing and industrial segments of the market. At the same time, strong labor markets conditioned investors and lenders to expect steady rent growth as part of their underwriting. This is changing. Cap rates are moving higher, capital availability is declining, and investors have become more discerning across real estate types and locations. As we consider new real estate allocations, we favor fresh and flexible capital sources that can opportunistically create value by solving someone else’s problem.

Secular growth pockets exist. We believe there remain numerous pockets of profits that stand to be disrupted. Candidates for such profit centers include banking and insurance, life sciences and services, and gaming, where technology change appears to be in the early stages of penetrating incumbent operators. In contrast, the pace of disruption in the most fruitful growth segments of the last cycle, such as media, cloud computing, and consumer internet, is likely slowing, making these more likely candidates for buyout investing. Pathstone’s private markets team is developing a strong pipeline to reflect this delineation – another reason to find liquidity!

Please see PDF for important disclosures.