FuturePath

The mission of FuturePath is to educate the rising generation, provide a community of peers, and empower them to take an active role in their family legacy.

The younger generations of highly affluent families have the opportunity of preserving and expanding their family’s legacy. In today’s world information is constantly evolving making it difficult to know what decision is right for you and your family. Who can you turn to get questions answered for the problems of tomorrow?

The FuturePath initiative by Pathstone is designed to tackle this question by directly engaging with the rising generation to ensure they are equipped with the knowledge and skills necessary to act as strong stewards of their family wealth.

It is our goal to help the next generation understand and embrace their role as stewards of the family legacy.

Kayly Gerowski

Director

We aim to educate on the creation and preservation of wealth through shared learning, interactive events, and peer engagement. The future leaders of Pathstone partner with the rising generation of clients to guide, teach, and empower them.

6 FuturePath Fundamentals

- Investments

- Values-Aligned and Impact

- Investing

- Budgeting

- Tax

- Philanthropy

- Estate Planning

Participants will network with other clients and build relationships with Pathstone experts. FuturePath equips participants with the tools they need to achieve their dreams.

Co-Chairman

Allan Zachariah is a co-founder and serves as Co-Chairman of Pathstone which serves families, family offices, and endowments and foundations. He is a shareholder and a member of the firm’s Executive Leadership Team. He served as Co-CEO from the inception of Pathstone through June 2022. Allan has over 41 years of professional experience as an advisor to families of significant wealth, designing sophisticated wealth transfer strategies for family businesses and high-net-worth individuals, and is a frequent speaker on wealth transfer techniques and family office structures.

Manager

Christine Fu is a Manager of Marketing in the Los Angeles office and is responsible for the Firm’s social media strategy. In addition to her marketing responsibilities, she provides executive level support to the Co-CEO, Steve Braverman, and assists in operations for the team. She is a member of the Firm’s next generation initiative, FuturePath, and is Chair of events for this Committee.

Director

Chris Martin is a Director and shareholder on the Diversifying Strategies team at Pathstone, based in the Boston Office.

Managing Director

As a Managing Director and Partner in Pathstone’s Washington, D.C. office, James (Jimmy) Whalen serves as the main point of contact to many of Pathstone’s most complex $100M+ client relationships. Jimmy is responsible for advising families on a variety of wealth management issues, including liquidity event transition, investment management, trust and estate planning, income taxes, and education for the next generation. He also serves as a leader to other advisors in the D.C. office, ensuring the successful delivery of wealth advisory services to clients while managing, mentoring, and assisting junior advisors towards reaching their own professional goals. Jimmy supports the firm’s Investment Committee on long-only manager selection and assists with business development for the greater Washington, DC area and East Coast.

Director

As a Director in the firm’s Seattle, WA office, Jesse is responsible for providing highly-customized solutions designed to improve and simplify the financial lives of the clients he serves. With more than 14 years’ experience, Jesse has led coordination and advising for clients on a range of complex solutions related to investment, estate, tax and insurance planning to help ensure families manage the impact of their wealth and assure that their financial planning strategy meets their goals and values.

Managing Director

Joe H. Dixon, III, a Managing Director in Pathstone’s Atlanta office, serves as the main point of contact for several clients. In partnership with others, he leads the tax services department and works to maintain processes that ensure quality tax services for clients. His focus is on tax compliance, estate planning, restructuring with family office management companies and carried interest structures, and other family office services.

Managing Director

John Workman is Managing Director and shareholder on the Investment Strategy Team at Pathstone, based in the Scottsdale Office.

Director

Kayly Gerowski is a Director at Pathstone, where she serves as an Advisory Services Lead for many of the company’s complex family office clients. She specializes in working with multigenerational high-net-worth clients, coordinating and collaborating to build the right financial plan to meet their goals and needs. In addition to her role on the Advisory Services team, Kayly is cross-trained in the Accounting & Financial Reporting department and manages the finances of several Pathstone client families. This includes overseeing daily invoice processing, quarterly financial reporting, and various duties to ensure clients’ needs are met.

President

Kelly Maregni is the President of Pathstone, the Modern Family Office, which serves families, family offices, and endowments and foundations. Kelly is the strategic leader and visionary of the Advisory practice, which includes Investment Advisory, Research, Tax, Accounting, Wealth Planning, and the Regional Leadership Teams. Kelly is a shareholder, a voting member of the firm’s Investment Oversight Committee, and a member of the Executive Leadership Team. Prior to her role as President, she served as the Chief Advisory Officer at Pathstone.

Executive Managing Director

Ken is the Executive Managing Director of Pathstone’s three Pacific Northwest regional offices, where he serves as a local resource to his talented teammates and works to ensure that clients have access to the firm’s deep resources as the team works collaboratively to deliver meaning, impact and results. Ken also himself serves as an advisor to individuals and families in the delivery of a comprehensive and integrated array of wealth management and financial stewardship outcomes. He is a shareholder of the firm and a member of the Investment Committee.

Prior to joining Pathstone in 2020, Ken served in various roles during a 26-year career at Cornerstone Advisors, including as the Chief Executive Officer from 2010-2020.

Associate Director

Ryan Siegel is an Associate Director at Pathstone. Ryan serves on the Client Advisory Team for numerous high-net-worth and ultra-high-net-worth clients. He helps provide customized financial solutions to meet clients’ needs, goals, and wealth objectives. Ryan is skilled in portfolio maintenance, asset allocation, investment performance analysis, financial reporting, and plan implementation. In addition, as a member of Pathstone’s FuturePath Committee, he seeks to educate the rising generation and empower them to take an active role in their family legacy.

Director

Sharon H Gupta is a key member of the Chief Marketing Office and Director of Marketing and Business Development at Pathstone. She oversees the Firm’s marketing efforts including brand, communications, digital, events, and PR, as well as sales strategy and prospecting. Sharon is part of the FuturePath and Impact Committees. Also, she serves as a mentor to Pathstone’s next generation of leaders and advisors through the Firm’s FuturePath initiative and co-directs the HerPath initiative.

With over 20 years of experience in the industry, Sharon is an experienced executive who specializes in High Net Worth marketing and branding. Previously, Sharon was Vice President of Marketing and Communications at Dynasty Financial Partners, a strategic partner of The Rudin Group, and led the marketing efforts at Fortigent (Fortigent was purchased by LPL Financial in 2012).

Co-Chairman

Steve is a co-founder and serves as Co-Chairman of Pathstone, which serves families, family offices, and endowments and foundations. He is a shareholder and a voting member of the firm’s Investment Oversight Committee and serves on the firm’s Executive Leadership Team. He served as Co-CEO from the inception of Pathstone through June 2022. Steve’s professional experience extends over 25 years of working with family offices and advising families on their wealth.

Insights

April 18, 2024

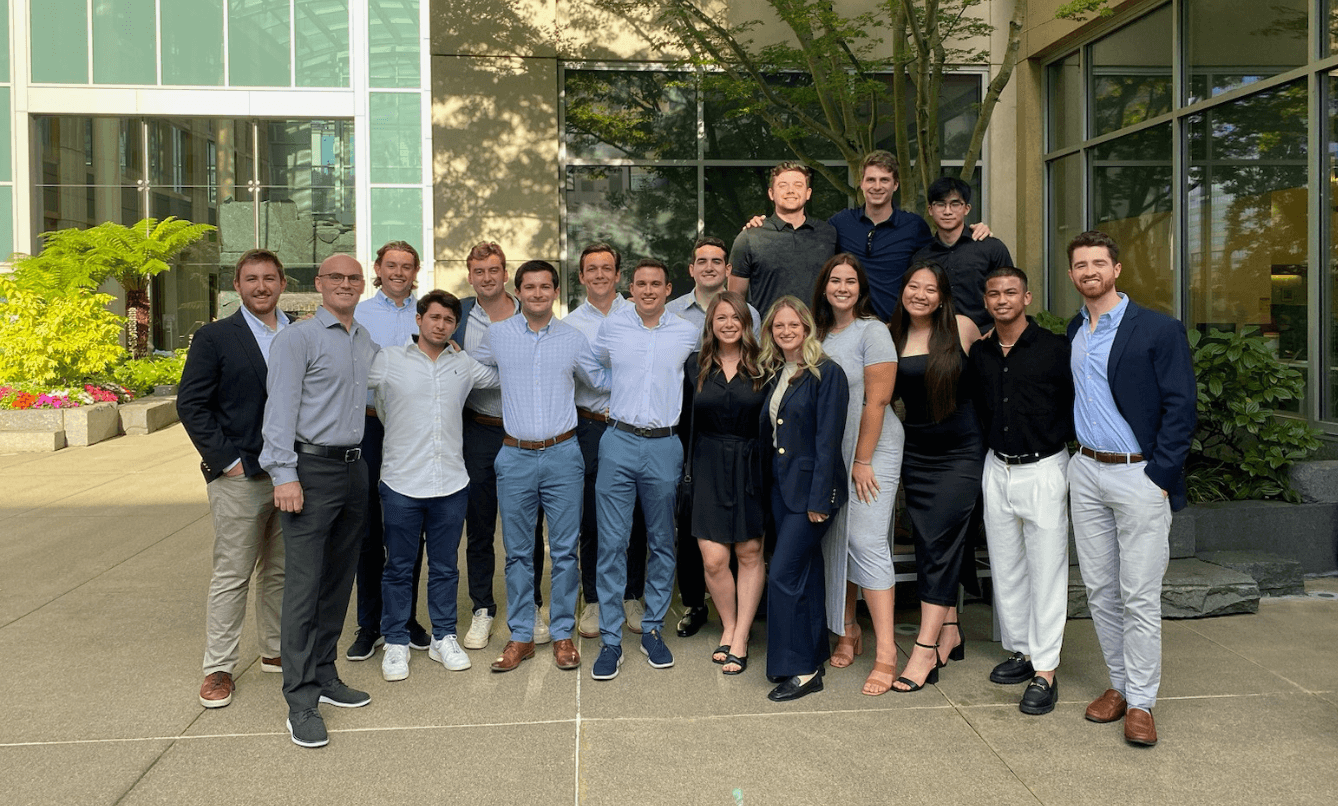

April is Financial Literacy Month, and to mark the occasion we are excited to share news of Pathstone’s inaugural six-week “Intern Rotational.”

This summer, interns will have the opportunity to learn from our talented team as they rotate through several different departments to gain a better understanding of how we serve and innovate on behalf of our clients.

August 31, 2022

A common struggle many families face is how to approach the “wealth conversation” between generations. As such, the majority of wealth transfers between generations fail due to of a lack of communication. Families simply aren’t talking to each other. Whether the conversation is spouse to spouse, parents to children, or advisors to clients, talking about money, wealth, and estate planning is crucial in setting up success for families.

July 27, 2022

Money can be a challenging topic of conversation for a parent to have with their children because the stakes feel high. In discussions around succession planning, the top concerns our clients share with us are: What will happen if I share too much? Will they lose motivation to work? Will they expect more support financially? Am I setting them up to spend lavishly?

Thoughts like these are common and understandable but worrying about the outcome should not stop you from doing the best you can to prepare for the moment they are in charge. These conversations often serve as an incredible opportunity to work as a family to determine what is important and to learn about each other. Approaching the discussion with an open mind and curiosity is key for you and your children to create a succession plan that works for both generations.