Selling Your Business

Advice from Entrepreneurs

Three Things to Consider

Before You Sell

Selling a business is a dream for many entrepreneurs, but it’s also a complex practical reality. As with any once-in-a-lifetime milestone, it can be helpful to hear from people who have successfully walked the path first. If you’re thinking about selling, consider these tips from founders who have sold their companies and gone on to create meaningful new chapters in their lives.

Access the three things to consider before selling your business.

1. Plan Early

To maximize your returns and enjoy a smooth transition, planning early is paramount.

Scott Lynes, founder of a wholesale apparel company that represented more than 40 brands, started by hiring a chief financial officer with experience preparing companies to be acquired. “I wasn’t even sure I wanted to sell but I figured that just in case we may as well get the house in order,” he says. “The best advice I got was to hire a CFO who could say, ‘Here’s what we need to tweak, here’s how to improve so we have the best product to put out there.’”

Justin Havlick, founder of a packaged snack food company with brands found in more than 40,000 U.S. retail locations, began preparing to sell his company at least two years prior to the transaction.

“We were asking questions like, are we set up to maximize opportunities and are we positioned in the right way?” Justin said. “Are we set up to accomplish our goals as a family?”

In addition to preparing the company operationally, legally and financially, Justin said estate planning and pulling off a family move from Colorado to Hawaii were also part of his two-year timeline. “That early preparation made a huge difference,” he said. “At the moment you feel the itch to sell, plan out how it will look. Build your professional team at that point.”

2. Find the Right Team

Managing a large transaction and all that goes into it is a team effort, and it’s critical to have the right relationships in place at the beginning of the process.

Justin says he was surprised by how much he and his family leaned on their financial advisors, private equity firm, accountants, attorneys, and others in the two years they spent planning to sell his food company. His financial advisors even helped manage key milestones and timelines over the two-year planning period.

“They were very disciplined in keeping us on track and project managing every aspect of the sale timing with and our family’s move,” he said. “Having the right team in place two years out and preparing every step of the way was key.”

Matt Rooney, a veterinary surgeon who sold his clinics, said having a trusted team to help assess prospective buyers and review the paperwork was pivotal in choosing the right buyer and getting the best possible deal.

“I had no business training, just a two-hour class in veterinary school, so I was kind of winging it,” Matt said. “Finding the right experts and learning from their skills and knowledge was key — I was like a sponge throughout that process.”

Matt chose Crestone (now Pathstone)-after a friend recommended them. He says he has relied on his advisors not only throughout the sale process but also for post-transaction investment advising, accountant referrals, legal support, estate planning – even travel agent referrals.

“The last thing I wanted was to manage money, so I was looking for a firm that could take care of it all,” Matt said. “The peace of mind that provides is wonderful.”

3. Build a Peer Support System

he adage, “It’s lonely at the top” often holds true for founding executives steering their own companies. Many entrepreneurs who have successfully sold their businesses say they benefited from being part of peer groups that bring founders together to share experiences and ideas.

For both Scott and Matt, being part of a long-term peer networking group played a large role in their decision to sell—and the support they got along the way. Scott, the apparel company founder, belonged to a group of chief executives across non-competing industries for more than 12 years. They helped him navigate challenges and eventually inspired him to sell his company.

“We’d have a day of roundtable discussions to talk about challenges in human resources, financing, sales, etc.,” Scott said. “I couldn’t talk to my employees about these challenges, so this group became a great sounding board. As I watched them sell their companies, I saw that there really can be life after your company.”

For Matt, forming a management group with other specialty vets was a gamechanger—one that wound up playing a direct role in his deal. After several years of meeting regularly to share best practices and listen to outside speakers on marketing and other topics, Matt and five participants in the group decided to unite their vet practices and sell them as one entity—enabling them to maximize the returns.

Finding Meaning and Cultivating Purpose

After the Deal

For many entrepreneurs who have spent years and sometimes decades building a company, a top concern about selling their business is what they will do—and who they will be—once they take the plunge.

Founders who once shared that concern but have since sold their companies and achieved a new level of freedom and wealth shared that there were two main tenets that helped them build a rewarding next chapter:

- Taking the time to explore without rushing into something new

- Following a path that brings a new sense of purpose

Here are their stories and advice:

Matt Rooney

Investing for Impact

After a career as a veterinary surgeon and practice owner, Matt invests using environmental, social, and corporate governance (ESG) considerations as a way to support his passion for wilderness conservation and the mitigation of climate change. “Since I sold, I’ve been looking for ways to make an impact for good,” he says. “The purpose is to work within the economic engine to make the change for the better and ESG funds are the first step in that.”

JUSTIN HAVLICK

Growing Local

After taking his smoked meat and sunflower seed brands into more than 40,000 locations across North America and selling his company, Justin moved to Kauai and focused on hyper-local food cultivation for the local island community (from beekeeping to growing vegetables for the food bank down the street). He and his wife also enjoy investing in local real estate. “It’s so easy to springboard from one transaction to another, but there’s value in pausing to explore different ways of living and being a professional with the expertise you have,” he says. “For me, it’s been fun to transition that into real estate investing.”

SCOTT LYNES

Exploring the World

When Scott sold the apparel company he had started more than a decade earlier with a stack of customized t-shirts, he’d never left the country. He decided he wanted to travel abroad, so he and his partner spent three years exploring the world. “I realized how much building my company defined so much of my world, including limiting my relationships,” Scott says. “When I asked myself, ‘What do I really care about?’ I got to travel and really be there for people, like attending my niece’s wedding.”

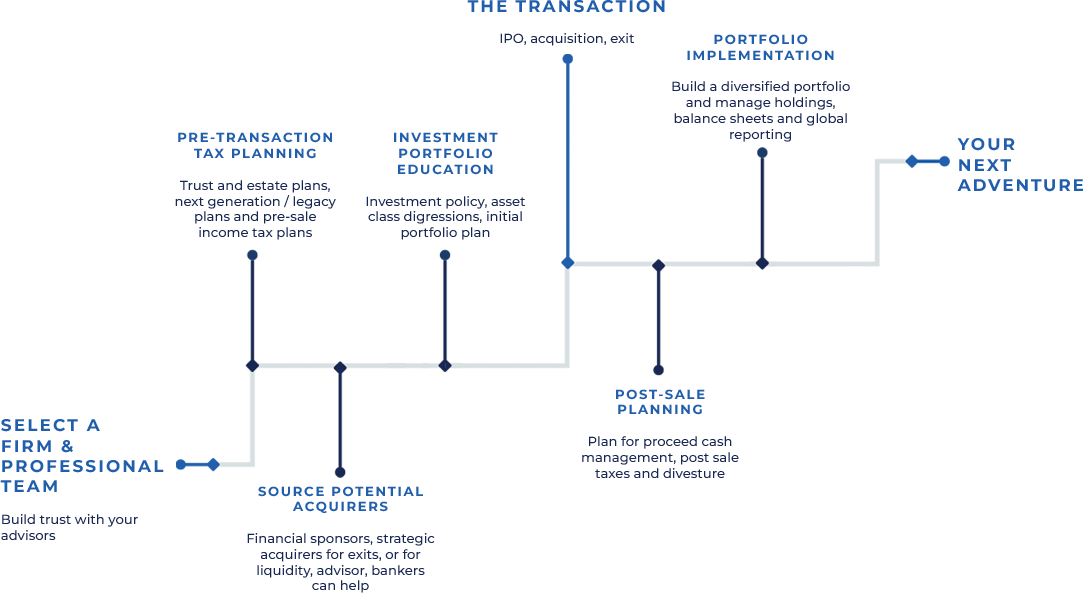

Liquidity Planning Timeline

Maximizing the benefits of a liquidity event, such as selling your business, requires careful consideration and strategic alignment with your personal life goals. To achieve the best possible outcome and avoid missing out on potential gains, it’s important to engage in thoughtful and proactive planning alongside a team of reliable wealth management professionals. These experts, bolstered by a network of experienced entrepreneurs, can provide valuable insight and help as you prepare to sell, maximize the transaction and secure your gains well into the future. By establishing a trusted partnership with your team 18 to 12 months in advance, you can seize the moment and make the most of your financial future. Here are the key elements of any transaction timeline:

Considering Selling Your Business?

Pathstone’s team help entrepreneurs plan for and execute the best possible deals. Discover Pathstone’s highly customized family office approach.

The testimonials above were provided by current clients based on their personal experiences with Crestone Capital LLC, which was acquired by Pathstone in April 2024. As no compensation was paid in exchange for the client’s testimonial, and no other material arrangement or relationship exists with the client other than the advisor/client relationship, Pathstone has no reason to believe that any material conflict of interest exists relating to these testimonials.