1. Key Decisions and Concepts for your Estate Planning Goals

Assets can pass to your heirs in multiples ways:

- through a Last Will and Testament and the ensuing probate process;

- by law (a key example of this includes property owned jointly with rights of survivorship, which automatically transfers to surviving owners at the first to die);

- by contract (examples of this include retirement accounts such as IRAs and life insurance contracts, which pass to the designated beneficiary); or

- according to the terms of a Revocable Trust that was executed during your lifetime. At your death, the Trust becomes irrevocable and its terms direct the disposition of Trust assets

Beneficiary selection is a key step to help ensure retirement accounts, life insurance, annuity contracts, or other assets are transferred as desired, and the transfer is completed as a matter of law. Depending on your estate plan, you may want to name your estate a beneficiary, a specific trust, or a family member as a beneficiary. Many assets allow you to name primary and contingent beneficiaries. Coordinating with your estate planning advisor will help ensure your desires are met and if you should name your estate, spouse, trust, or other family member.

When you meet with your estate planning attorney, you will be asked to name multiple individuals to different roles. Your executor will serve as your personal representative when you pass away and bear a lot of the responsibilities in winding down your estate in an efficient manner. This individual will obtain a copy of your will, file it with the probate court, notifying various agencies of your death, manage the assets of your estate until they are distributed to the beneficiaries, file and pay taxes related to your estate, and dispose or distribute property. The executor is typically compensated between 1%-5% of the assets in the estate or a flat annual amount stated in your will. Other key roles include the guardian of your minor children and trustees of any trusts created by your estate.

When you pass away, you may owe estate tax on your assets before anything is distributed out to beneficiaries. Current law provides taxpayers with $11,700,000 of exemption which allows taxpayers to transfer that amount out of their estate without paying tax. Any assets above the $11,700,000 amount are taxed at 40% with some exceptions. Legislation passed at the end of 2017 increased the exemption from $5,490,000 to $11,580,000 but is set to revert to the prior amount adjusted for inflation after 2025. The current administration may pass legislation to increase the tax rate to 45% to 50% and decrease the exemption to “historical norms,” which may be anywhere between $1,000,000 and $3,500,000. Taxpayers can transfer assets to their spouse under the Marital Exception and avoid using lifetime transfer exemption or paying estate tax. Another exception to the exemption and tax is transfers to charitable organizations. In addition to the estate tax and lifetime exemption, taxpayers need to be wary of the Generation Skipping Transfer tax and exemption. Transfers to grandchildren or unrelated individuals 37 ½ years younger, or trusts for their benefit, may be subject to GST with some exceptions. Similar to gifts and estate transfers, the GST has a lifetime exemption you can use to avoid paying tax on transfers.

Some estate plans include a simple “I love you” language and transfer assets to a spouse, outright. In addition to the assets, taxpayers transfer any remaining lifetime exemption to their spouse through Portability and a timely filed estate tax return. This can be impactful as the surviving spouse can transfer both their deceased spouse’s exemption amount and their own before being subject to estate tax. You should be mindful when remarrying as the exemption transferred under portability will be lost. Some estate plans call for more complex planning with family trusts, marital trusts, and Dynasty trusts to allow taxpayers to efficiently transfer assets to future generations and take advantage of the transfer tax laws. Philanthropic trusts can be used to reduce estate taxes as well.

2. Titling Considerations

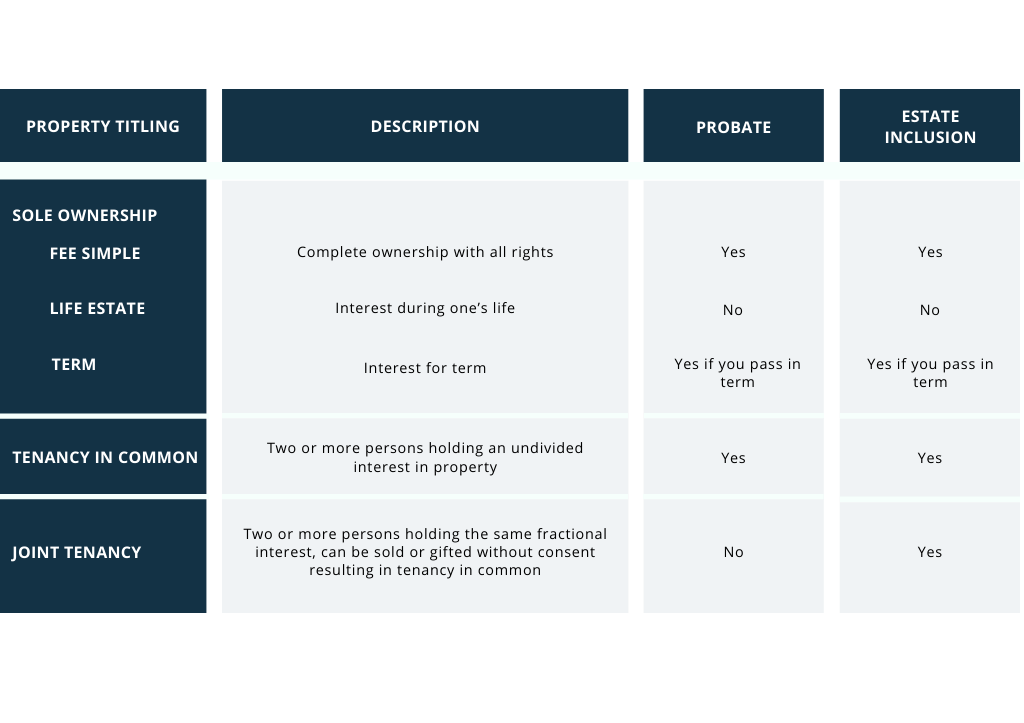

How your home or other assets are titled can have an impact on what happens to the asset when you pass away. Three types of ways property can be titled are Sole Ownership, Tenancy in Common, and Joint Tenancy. Below is a summary of the different ways property can be titled and the impact on the asset passing through probate court or being included in your estate for tax purposes. The ownership of your home and deed is a starting point for titling considerations but if you are utilizing a revocable trust in your estate plan, it will be important to have all of your assets titled correctly.

3. Transfers at Death

Transfers at death can occur by Will, Law of Intestacy, Law (jointly held property), Contract, or Trust. Depending on how your assets are titled and what estate documents you have in place, your assets will be transferred under state law. Transfers by Will pass through probate court and your Last Will and Testament will govern asset transfers from your estate. If you have no Last Will and Testament, the laws of intestacy will govern the transfer of your assets through probate depending on state law with assets going to the surviving spouse and or children or grandchildren. Jointly held property, contracts, and trusts transfers are all governed by law and the assets do not pass through probate. As mentioned earlier revocable trusts are a common tool for efficient estate planning for high net worth individuals.

4. Estate Planning Pitfalls

Facing a tragedy without these documents in place can be disastrous. A probate court can assign a guardian as well as a conservatorship. Assets can be held up for a long period of time and the costs for resolving disputes can be high.

Using a qualified estate planning attorney is important when coordinating all your estate documents. Having your documents properly notarized and witnessed, storing them so family or your agent can access them, providing copies to hospitals and financial institution in advance so they are on file when needed are all important steps to ensure you are prepared for the unexpected.

Some wills can be too simple and lead to ambiguity and or litigation. Improperly titled assets, life insurance that is not owned outside of your estate, or incorrect designations for executors, trustees, managers, and personal representatives can have dire consequences on your estate and assets. Without planning, family businesses, land, or other illiquid assets can lead to estate liquidity problems.

Life is constantly changing as is federal and state legislation that will impact your estate plan and other estate planning documents. We recommend reviewing your documents and discussing with advisors annually to ensure you are prepared for the future.