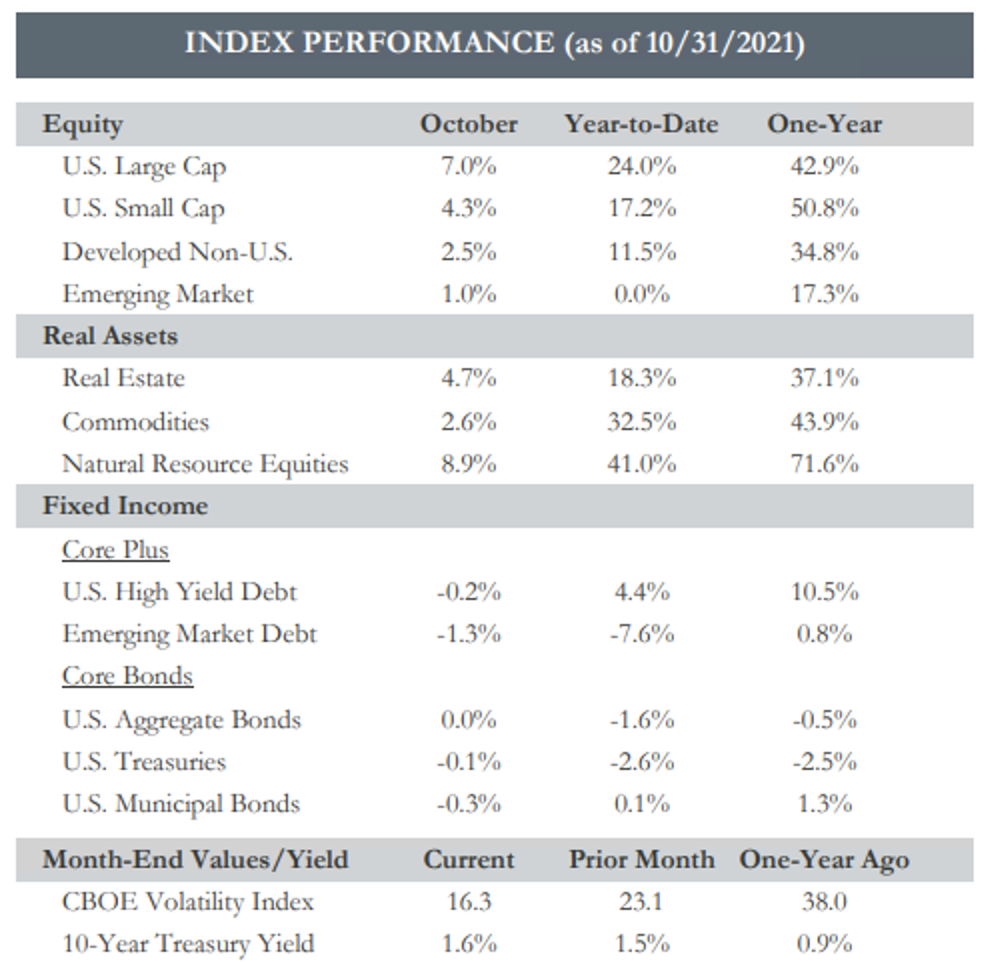

October saw energy prices rise due to supply and demand related issues. Natural Resource Equities reaped the benefits of higher prices, increasing 8.9% during the month. Heightened inflation continues to persist as the CPI increased 6.2% YoY as of the end of October. The Fed believes that as the job market strengthens, inflation will start to normalize. The Fed also announced tapering of its $120 billion-per-month bond buying program. Heightened inflation may force the Fed to raise interest rates sooner than anticipated.

Key Takeaways:

- Equity Markets reached new highs in early November as the Federal Reserve made its announcement to taper the monthly bond purchases the central bank implemented at the start of the pandemic. Natural resource equities, in particular have soared in late October and early November.

- Energy prices are expected to inch up further in 2022 after surging more than 80% in 2021, fueling significant near-term risks to global inflation. As pandemic restrictions eased the demand for oil has increased while the combination of domestic supply interruptions and trouble in energy markets overseas have made crude oil more expensive.

- Inflation has continued to creep up through the end of October. In November The Federal Reserve claimed that the current state if inflation is expected to be “transitory” and that price pressures will ease and pave way for stronger employment and economic growth in the months to come.

- Core Bonds give up even more ground in October as yields curves flatten. This is due to the FOMC’s plan to begin tapering its $120 billion-per-month bond buying program. Some investors worry that rising inflation will force the central bank to unwind its bond buying faster and eventually raise interest rates even sooner.

Source — Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices. You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved. Returns over one year have been annualized.