Key Takeaways

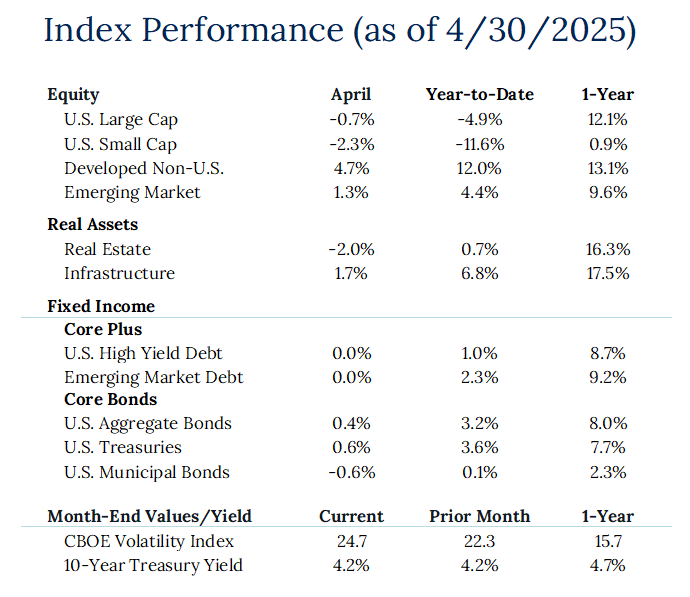

Market News: The first estimate of Q1 U.S. Real GDP came in at -0.3%, the worst since Q1 2022. Inflation and unemployment data remain tame for now, but the Fed remains hesitant to lower interest rates with the threat of higher prices on the horizon. The next Fed meeting is May 7th. President Trump’s tariff announcements this month saw the VIX (CBOE Volatility Index), sometimes referred to as the fear index, spike above 57 before settling back below 25 at month end.

International Equities: The US Dollar dropped nearly 4% (“Bloomberg US Dollar Spot Index”) in April relative a basket of ten major global currencies and more than 6.5% year-to-date propelling Non-U.S. equity returns ahead of U.S. equities. Those returns likely overstate the strength of non-U.S. economies as the International Monetary Fund has cut its global growth forecast in the face of trade tensions.

Fixed Income: Despite heightened volatility in the U.S. Treasury market to start 2025, returns have been quite strong through the first four months of the year. Municipal bonds, on the other hand, have lagged Treasuries as they gave up some of the relative advances they enjoyed in 2024.

In Other News: California surpasses Japan to become World’s Fourth Largest Economy. The European Central Bank Cut Interest rates for 7th time in April. Gold prices hit an all-time high of $3,500 per oz in April but ended the month below $3,300.