Scale Matters in Private Markets

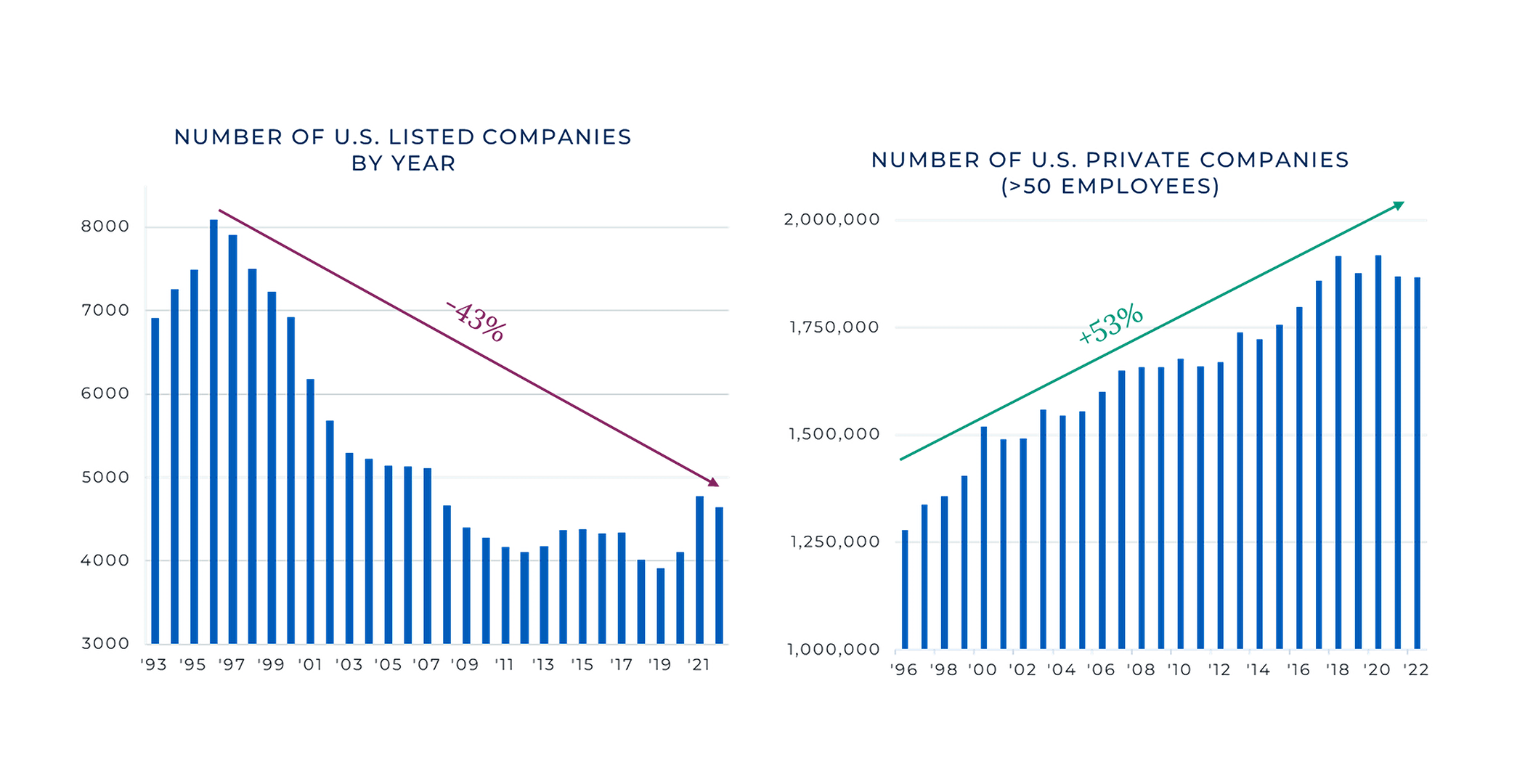

There are many reasons for the changes discussed above, but one of the primary drivers linking them is “scale.” According to McKinsey & Company, private market Assets Under Management (AUM) stand at roughly $13.1 trillion, of which $3.7 trillion is “dry powder” (committed capital waiting to be deployed). The impact of this capital has led to many companies going private and companies staying private longer. SpaceX is an extreme example of this, having recently completed a private round of financing at a $350 billion valuation. Clearly companies can now grow substantially without tapping public equity markets. As a result, IPO activity has declined and the number of private companies has increased.

Scale is also important for private market investors, often referred to as Limited Partners (LPs). Many pools of LP capital come from increasingly large institutions, such as sovereign wealth funds, pensions, and college endowments. This enables certain investors to gain access to privileged investments and negotiate advantaged terms. Examples of these terms include seats on LP Advisory Committees (LPACs), reduced fees, and access to co-investments.

In some ways it parallels the flying experience of travelers. The vast majority of travelers take commercial flights and some even enjoy perks, such as boarding early and sitting in more comfortable seats. However, the truly privileged travelers fly privately, and the entire experience revolves around their schedule. As private markets opportunities have emerged against this backdrop, our dedicated team is seeing more opportunities to leverage the growing scale of Pathstone to negotiate these benefits on behalf of clients in order to enhance their investment experience.