Just in the 21st century, we have seen market agitating events like the Dot-Com Bubble Burst, 9/11, U.S. invasion of Iraq and Afghanistan, the Global Financial Crisis, the Covid-19 Pandemic, and now the war in Ukraine. Over this time period, the S&P 500 (U.S. Large Cap Equity Index) has had 8 unique drawdowns of 10% or greater, including a maximum drawdown of 55.3%, yet has delivered a total annualized return of 7.1%. Every year presents dozens of reasons to sell, as illustrated below. It might seem like it is a good time to de-risk, take some money off the table, ignore your long-term plan, and wait for calmer times. Who could blame you? Sticking to your plan and keeping a long-term view by staying invested is hard, especially when the market is dropping. After each subsequent drop, the decision not to change your investment strategy might seem increasingly regrettable. Everything appears obvious in hindsight.

During tumultuous times, generally, two narratives present themselves. Either the current news sets up exactly like some horrific event of the past and markets will fall, or markets can’t go up because this time is different, and markets will fall. People on social media and in the news start panicking due to market volatility. That’s because they don’t have a plan. Large drawdowns in the market and uncertainty are not fun to live through, but these three ideas might help you stay invested in your strategy and keep a long-term view.

Staying Invested Yields the Best Results

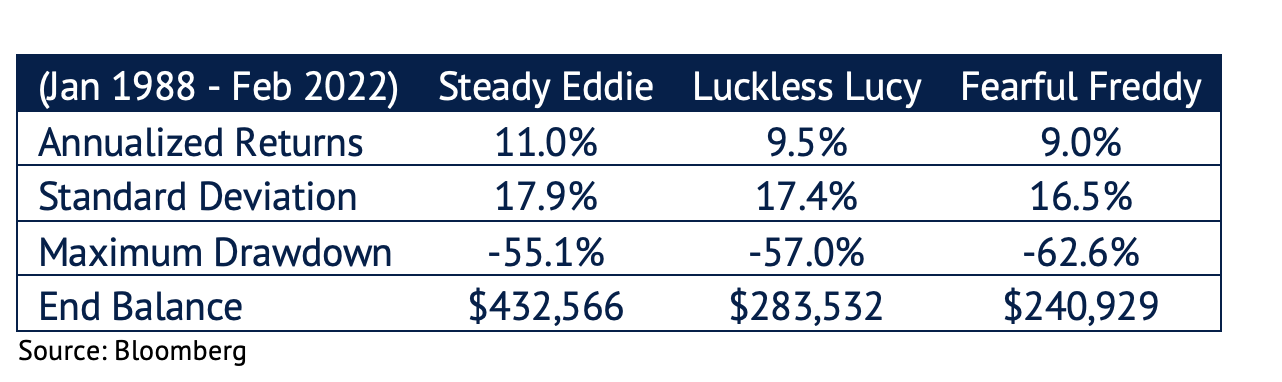

To illustrate this point, let’s examine the investment strategy of three investors: Luckless Lucy, Fearful Freddy, and Steady Eddie. Luckless Lucy is the worst market timer in the world. Lucy deposits $1 per day into a cash account which earns 0% and only invests that cash in U.S Large Cap equities (S&P 500 Index) at the peak of the market right before a minimum of a 10% drawdown and then keeps that money invested. The day after a market peak, each daily deposit is invested at 0% until the next market peak.

Freddy starts fully invested in the S&P 500 and his $1 deposit per day is also invested in the S&P. When the market has a down day of 3% or more, he sells everything and goes to cash for a minimum of two days and doesn’t buy back in until the market has a positive day.

Eddie starts fully invested and invests every $1 deposit into the S&P 500 and never pulls that money out. All investors start with a $10,000 balance at the beginning of 1988.

By February 2022, Steady Eddie’s strategy proves to be the best from a total return perspective with an annualized return of 11.1%. Eddie’s ending balance is $432,566 which is almost $150,000 more than Lucy and over $190,000 more than Freddy.

Steady Eddie having the best performance isn’t exactly shocking. What might be shocking is that the worst market timer in the world, Lucy, actually outperformed Fearful Freddy in this scenario. While Freddy’s returns did have a lower standard deviation (a lower standard deviation is generally considered less “risky”), his maximum drawdown was still worse than Lucy’s and his ending balance was over $42,000 lower. Keep in mind, that this is ignoring any tax consequences and trading costs associated with selling, which would hurt Freddy’s strategy even more since he sells his investments. What this proves is that altering your plan during the harshest market downturns can be incredibly detrimental to long-term performance.

Market Timing and Missing Out

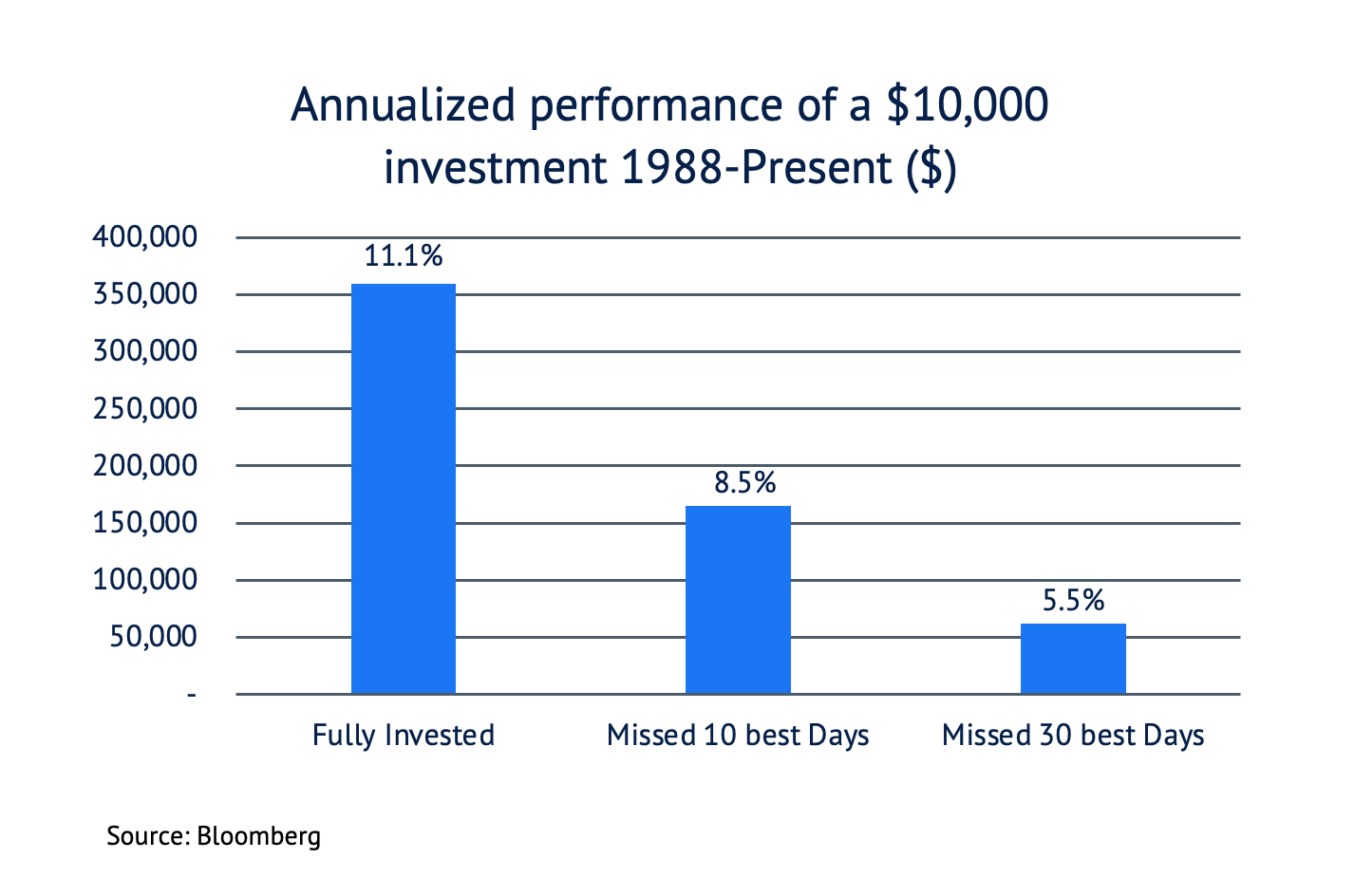

Let’s take a closer look at why Freddy underperformed by such a wide margin. We as investors have some challenging decisions to make during times of market turbulence. If we get out of the market to avoid a drop, we also need to get back in. Getting back in at the wrong time might mean missing out on the rebound gains.

Take the S&P 500 Total Return Index from 1988 to present-day (index inception to date). It had an annualized return of 11.1% over the full period. If we remove the top 10 days (0.12% of days during the period) the annualized return drops to 8.5% and nearly $195,000 worse off from a $10,000 initial investment. If we remove the top 30 days (0.35% of days during the period) it lowers even further to 5.5% and nearly $300,000 worse off from a $10,000 initial investment.

You might be thinking to yourself how unlikely it would be to miss these days that just so happen to provide the best performance. Not as unlikely as you might think as 73% of the best days fall within two weeks of the worst-performing days. If you got out, most likely you missed out.

Investing in a High Probability of Success

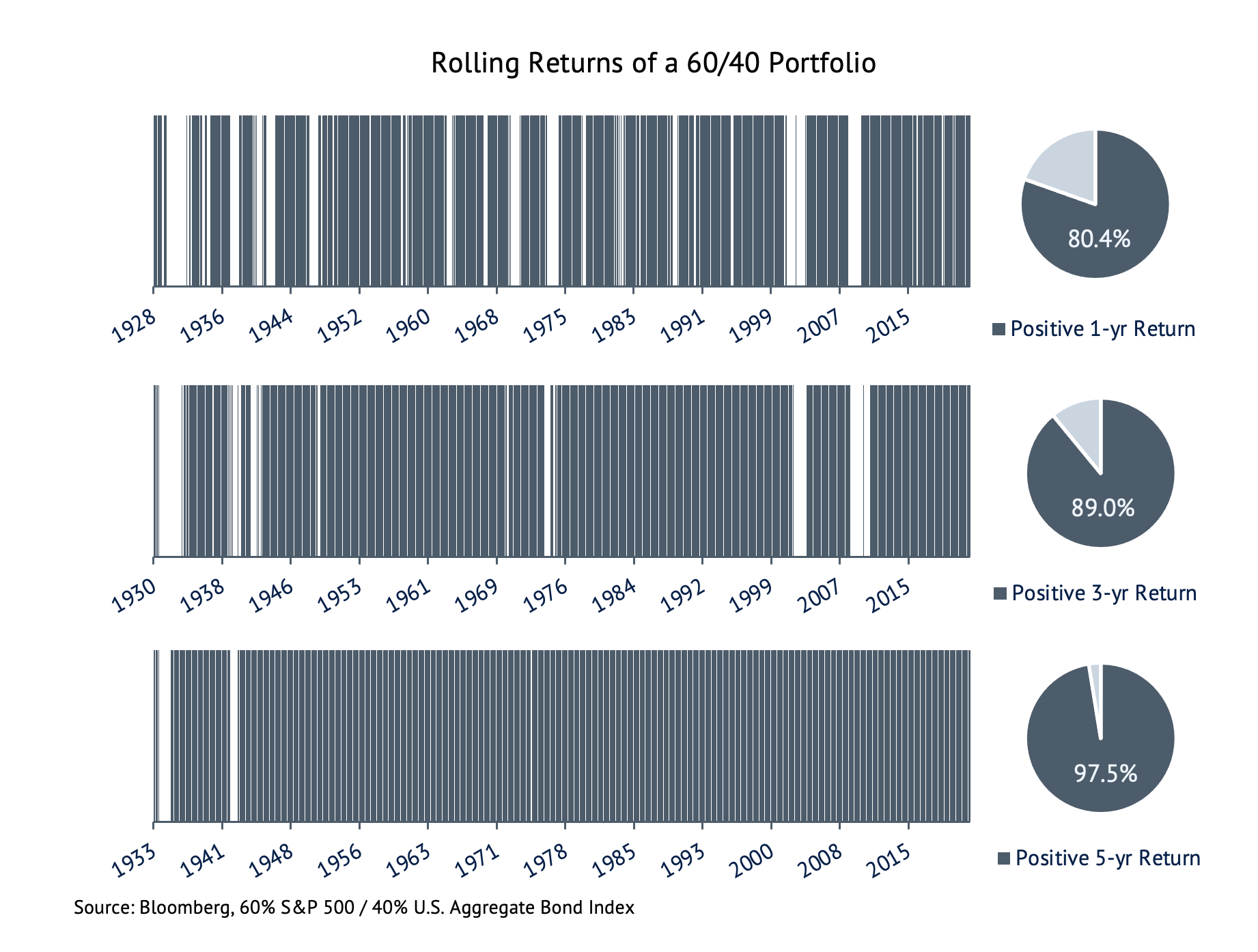

When looking at rolling returns starting in 1927, the S&P 500 has a positive total return in 75.3% of 1-year periods, 83.9% of 3-year periods, and 93.7% of 5-year periods. The results are even better for a 60/40 portfolio (60% stocks / 40% bonds). The only 5-year periods where a 60/40 portfolio did not have a positive return were during the Great Depression and World War II, two of the most significant events of the prior century.

As painful as losses feel, even a simple portfolio of U.S. stocks and bonds historically has been positive after 5 years 97.5% of the time. This is why keeping a long-term view is so important. That knowledge and perspective shield you from the anguish of short-term losses since you know that a diversified, risk-appropriate portfolio will win out.

Have a Plan That Matches Your Long-Term Goals

On any given day, including a market drop, the best thing we can all do is stick to the plans that we made during calmer times. This is why athletes practice and train for specific scenarios. They put themselves in difficult situations so when they present themselves in-game, they don’t panic but stick to the plan and execute that plan. If you are having concerns about possible drawdowns or market volatility, reach out to your advisor to work through your risk appetite and position your portfolio for success in difficult environments. The economy might take a big hit and stocks might continue to drop, but you should know that you are invested in a diversified and risk-appropriate portfolio. A portfolio that matches your return expectations and risk tolerance. In the moments when things are uncertain, it can be challenging to make good long-term decisions. It’s important to have a plan that works for you and the inevitable periods of market uncertainty are the most important times to stick to that plan.

For more on planning your financial future, click here.

Please see the PDF version of this article for important disclosures.