April marked the first month since April of 2022 where the S&P 500 had positive year-over-year returns. Payroll data came in above expectations and inflation cooled to its lowest level in almost two years. The Fed hiked interest rates again to 5.25% despite ongoing issues within the banking sector. The treasury yield curve continued to get more inverted, but equity markets have shrugged off all signs of distress up to this point as the S&P 500 is up over 9% YTD.

Key Takeaways

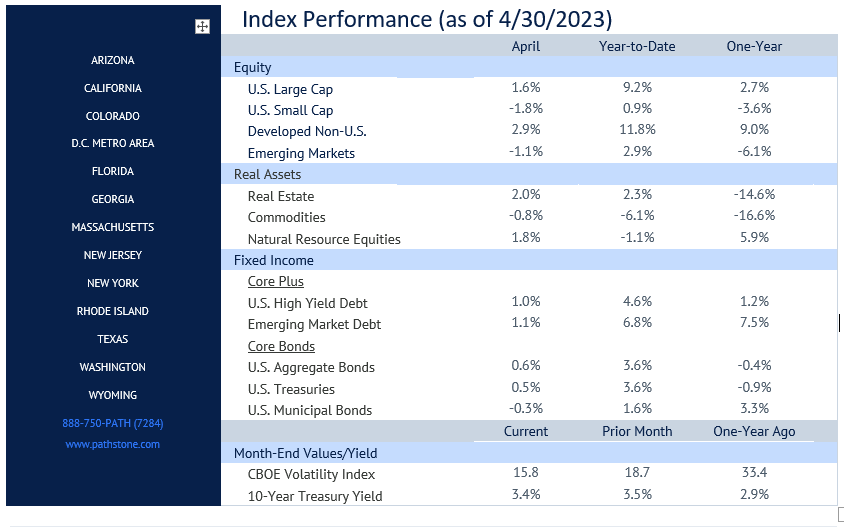

- Back in black! The S&P 500 as of the end of April was back in positive territory on a year-over-year (YoY) basis. The S&P was up +1.6% and the tech heavy Nasdaq was flat for the month.

- Developed ex-U.S. large cap equities were up +2.9% in April and are up almost +12% for the year. European equities were up +4.2% and Japanese were up closer to +0.4% for the month. Developed ex-U.S. equities have outperformed U.S. large caps by +6.3% over the past year. Emerging Market equities were down -1.1% in April as Chinese equities sold off almost -5.2% and join U.S. small caps as underperformers for the year.

- The Federal Reserve agreed to raise the Fed Funds rate to an upper bound of 5.25%. This expected move among other factors prompted the treasury yield curve to invert further in April, which helped long-duration bonds outperform. Riskier bonds (high yield/EM debt) have been rewarded so far in 2023. Credit spreads have not widened much this year and volatility (VIX) has dropped meaningfully.

- The advance report for Q1 real GDP came in a little lighter at +1.1% vs. +1.9% estimated and +2.6% in Q4 2022. Inflation came in a little lower than anticipated and the YoY figure dropped to +5.0% from +6.0%. Headline CPI is now down to its lowest level in nearly two years. The number of jobs added to the economy surprised to the upside and unemployment rate fell slightly, but jobless claims, continuing claims, job openings, and layoffs all continued to weaken. Retail sales were weak as well and while the manufacturing sector data improved, it entered its longest contractionary streak since 2009.

- The turmoil in the banking sector has not caused much distress among public equities to this point. Large cap financials were up in April after being down -9.6% in March. The S&P 500 gained +5.0% over the past two months while regional banks dropped -37.3%.

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved. Returns over one year have been annualized.

Source — Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices.

Please see PDF for important disclosures.