- Trade wars and falling interest rates dominated investment headlines in August, as Presidential tweets seem to be the source of more short-term volatility. Equity prices fell, as investors grew anxious over increasing trade conflicts and concerns about slowing global growth.

- Despite the down month, the S&P 500 is up an impressive 18% year-to-date and closed the month within 4% of all-time highs. U.S. Large Caps continue to outshine their foreign counterparts. Safe haven assets, such as gold, have caught a bid recently. Gold prices increased by over 7% in August.

- The most dramatic move during the month was the fall in interest rates. Global interest rates continue to fall further into negative territory. The 10-year Treasury yield dropped from 2.0% to 1.5% in August, resulting in core bonds delivering the best performance for the month. The swift fall in longer term interest rates left the yield curve inverted between the 10-year and 2-year rates.

- Markets are pricing in a near certainty of another rate cut by the Fed at the September meeting, and investors will keep a close eye on the Economic Projections released for further clarification on the outlook of monetary policy.

- Uncertainty over trade, Brexit, and protests in Hong Kong is likely to continue dominating headlines and fueling volatility over the near term.

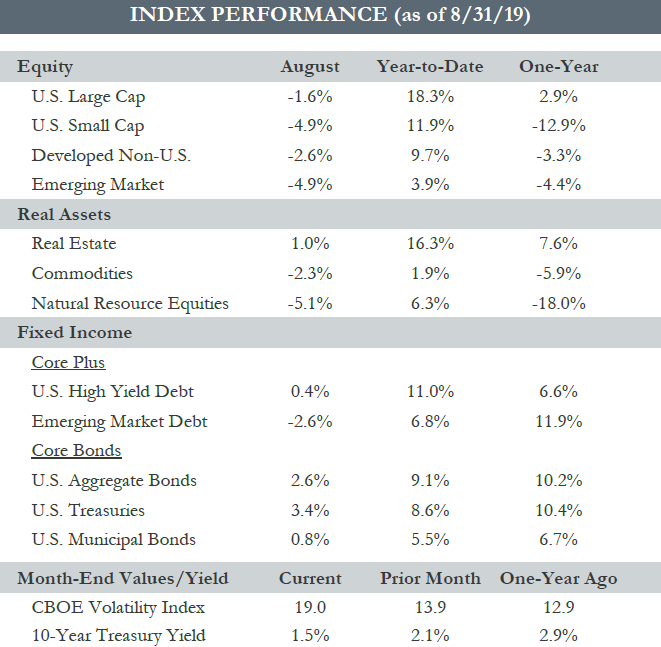

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved.

Source — Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices.

Please read important disclosures in the PDF version of this article.