Key Takeaways

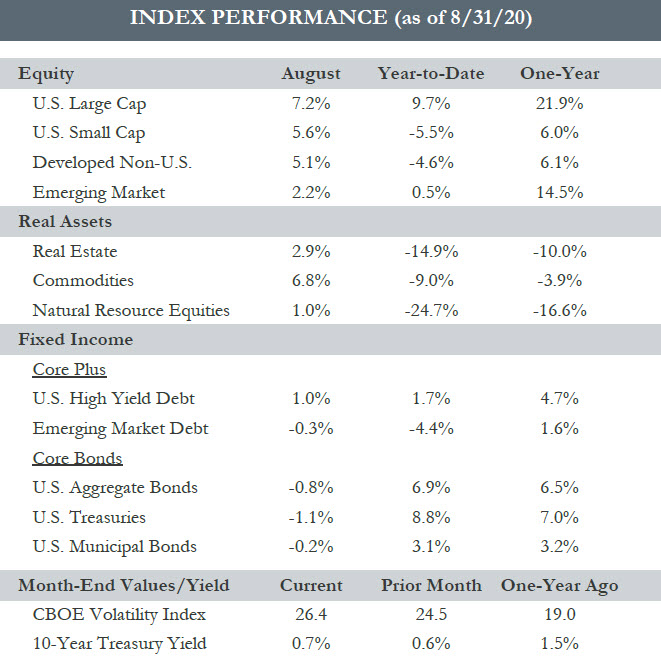

- Equity markets climbed higher in August, the fifth positive month in a row for the S&P 500. Led by the usual suspects, the mega-cap growth companies, the index was propelled to new all-time highs.

- Treasury yields ticked higher during the month, causing traditional core bond indices to post slightly negative returns while credit spreads narrowed, generating positive returns for the High Yield Index.

- Data releases have been consistent with the economy traveling down the road to recovery. Housing has been quick to snap back with record-low mortgage rates. Durable goods orders show demand for manufacturers perking up. Consumer spending increased for the third month in a row.

- Coming out of the Jackson Hole Conference, Jerome Powell announced a monetary policy shift targeting an average inflation rate of 2%. In practice, this allows the direction of policy to focus on employment rather than inflation. Interest rates should remain low for longer, allowing inflation to run slightly above 2% before the Fed would hike interest rates.

- Some European countries have seen an uptick in virus cases, putting the brakes on re-opening plans. Meanwhile, in the U.S., Congress has yet to come to an agreement on the next round of stimulus as political noise grows louder heading into the Fall election season.

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved.

Source — Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices.

Please see the PDF version of this article for important disclosures.