August was a difficult month for markets. The S&P 500 and Nasdaq fell -1.6% and -2.1%, respectively. Bonds fared little better, with yields rising during the month. Jobs grew faster than forecasted in August; however, this was the third consecutive month of gains below 200k and figures for the prior two months were revised lower by a combined 110k. Inflation edged a little higher and the headline Consumer Price Index now stands at 3.2% year over year after rising 0.2% since last month.

Key Takeaways

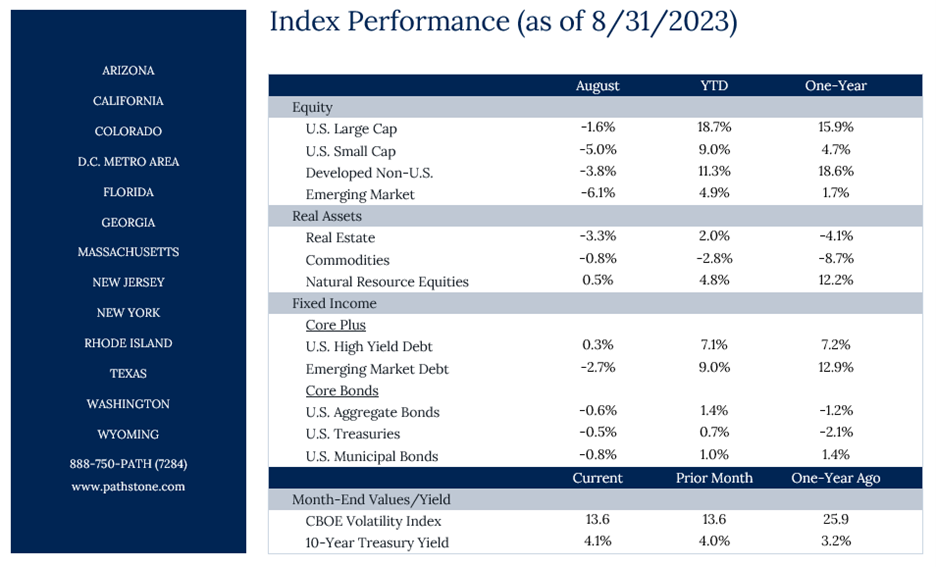

- August was a difficult month for markets, with the S&P 500 and Nasdaq falling -1.6% and -2.1%. Small caps, Developed Int’l, and EM fared even worse. After gaining 15% in the previous two months, US Small caps experienced their worst month since December 2022, indicating some consolidation and profit taking. As the U.S. dollar rose, Chinese shares fell nearly -9% in August. Oil prices continue to rise as additional production cuts were announced.

- Bonds fared little better, with yields rising during the month. The 10-year treasury yield fluctuated between 4.0% and 4.3% before settling at 4.1%. Yield volatility has increased significantly, and short-term bonds outperformed throughout the month. The heightened volatility was partly attributable to Fitch downgrading the U.S.’s credit rating from AAA to AA+.

- Jobs grew faster than forecasted in August. The U.S. economy added 187k jobs which was higher than the 170k estimated. However, this was the 3rd consecutive month of gains below 200k and figures for the prior two months were revised lower by a combined 110k.

- Inflation edged a little higher and headline CPI now stands at +3.2% YoY after rising +0.2% MoM. This did match analyst estimates, but eyes will be focused on the print for August as it is likely to move even higher due to increased energy costs.

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved. Returns over one year have been annualized.

Source — Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices.

Disclosures

Past Performance Is No Guarantee of Future Performance. Any opinions expressed are current only as of the time made and are subject to change without notice. This report may include estimates, projections or other forward-looking statements, however, due to numerous factors, actual events may differ substantially from those presented. The graphs and tables making up this report have been based on unaudited, third-party data and performance information provided to us by one or more commercial databases. Additionally, please be aware that past performance is not a guide to the future performance of any manager or strategy, and that the performance results and historical information provided displayed herein may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Therefore, it should not be inferred that these results are indicative of the future performance of any strategy, index, fund, manager or group of managers. While we believe this information to be reliable, Pathstone bears no responsibility whatsoever for any errors or omissions. Index benchmarks contained in this report are provided so that performance can be compared with the performance of well-known and widely recognized indices. Index results assume the re-investment of all dividends and interest. Moreover, the information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or advice to purchase or sell any security, investment, or portfolio allocation. Any investment advice provided by Pathstone is client specific based on each clients’ risk tolerance and investment objectives. This presentation is not meant as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s accounts should or would be handled, as appropriate investment decisions depend upon the client’s specific investment objectives.

U.S. Large Cap Equity is represented by the S&P 500 Index, with dividends reinvested. U.S. Small Cap Equity is represented by the Russell 2000 Index. Developed Non-U.S. Equity is represented by the MSCI EAFE Index. Emerging Market Equity is represented by the MSCI EM Index. Real Estate is represented by the S&P Global Property Index. Commodities are represented by the Bloomberg Commodity Index. Natural Resource Equities are represented by the S&P North American Natural Resources Index. U.S. High Yield Debt is represented by the Bloomberg Barclays U.S. Corporate High Yield Index. Emerging Market Debt is represented by the JPM GMI-EM Global Diversified Index. U.S. Aggregate Bonds is represented by the Bloomberg Barclays U.S. Aggregate Bond Index. U.S. Treasuries is represented by the Bloomberg Barclays U.S. Treasury Index. U.S. Municipal Bonds is represented by the Bloomberg Barclays Municipal 1-10yr Index.