February was a tough month for broad market performance. Inflation for January came in higher than expected and markets are finally buying into the Fed’s narrative that interest rates will and can be at increased levels for longer than was once thought. Treasury yields rose considerably as did inflation expectations on the news.

Key Takeaways

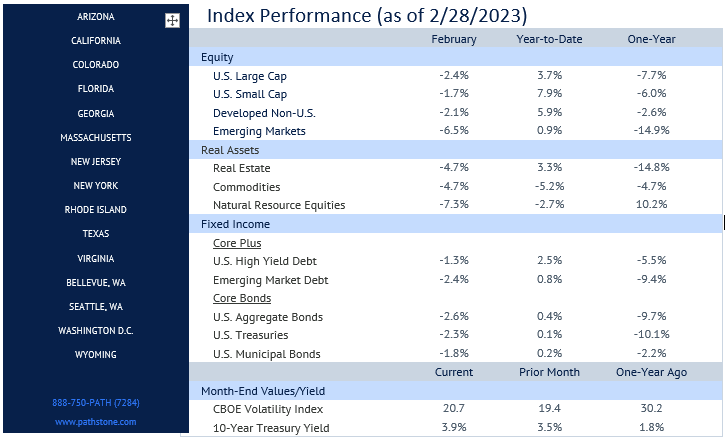

- February was the worst month for broad market performance since September 2022. Inflation for January was higher than expected and markets are finally buying into the Fed’s narrative that interest rates will and can be at increased levels for longer than was once thought. The 10-year treasury yield hopped 40 basis points to 3.92% and the 2-year increased 78 basis points to 4.82%. Fixed income markets sold off as treasury yields pushed higher.

- The S&P 500 was down -2.4% and the Nasdaq was down -1.0% for the month. Small caps broadly outperformed large cap equities and growth outperformed value. The tech sector was the only U.S. equity sector with positive performance during the month. Energy, REITs, and utilities were the laggards for February, all down more than -5%.

- International performance was mixed. Developed ex-U.S. large cap equities were down -2.1% as European equities were down just -0.6% and Japanese were down closer to -3.8%. While Emerging Market equities were down closer to -6.5% in February. Chinese equities sold off hardest, down almost -10.4% after being up over +52.0% the previous 3 months.

- During February’s FOMC meeting, they agreed to lift the Fed Funds rate another 0.25% to an upper bound of 4.75%. With higher than expected inflation and expanding labor market, projections for the Fed Funds rate for the end of 2023 have risen significantly. Markets are currently pricing in 3 more 0.25% hikes to a terminal rate of 5.5%, up from 5.0% at the end of 2022.

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved. Returns over one year have been annualized.

Source — Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices.

Please see PDF for important disclosures.