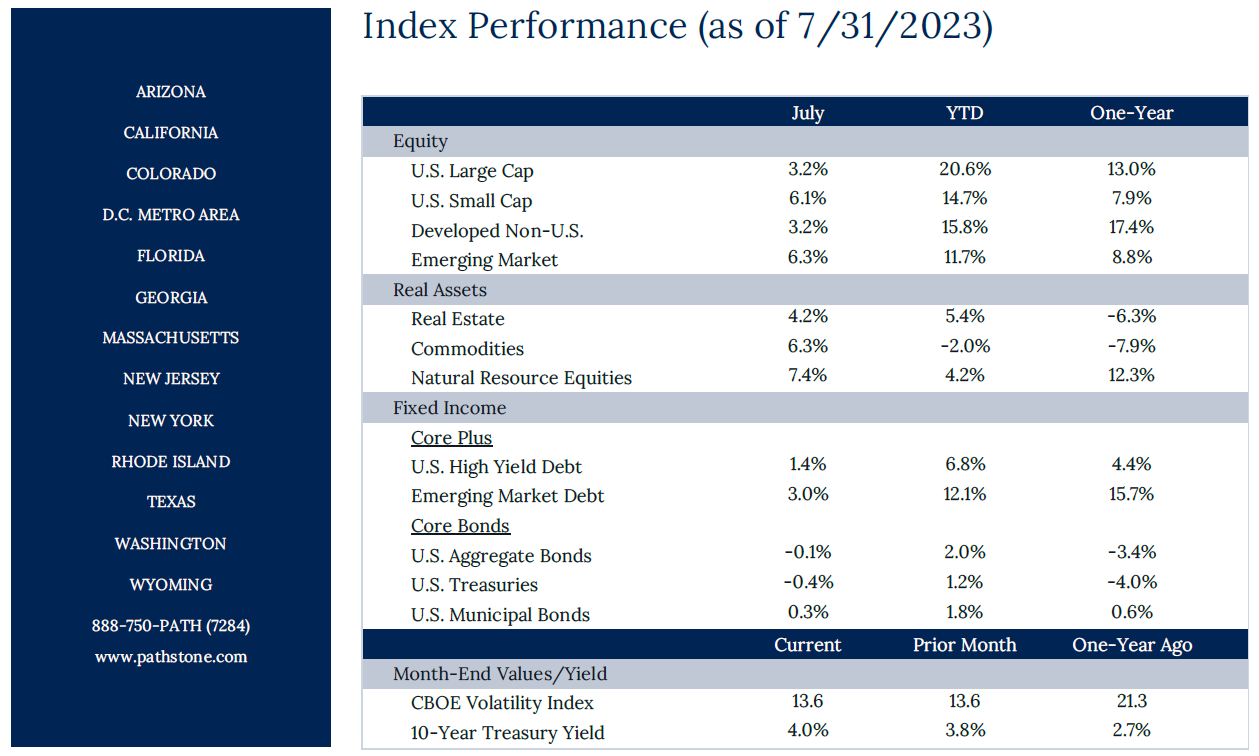

July saw strong equity performance, with the S&P 500 up 3.2% and the tech-heavy Nasdaq up over 4.0%. Small caps outperformed large caps as energy and financials rebounded. Credit continued to perform well vs. less risky bonds, with high yield bonds and EM debt returning +1.4% and 3.0%, respectively. The US economy grew +2.4% in Q2, driven by strong business investment and consumer spending, but job growth was tepid after adding only 187k jobs which was less than expected.

Key Takeaways

- July was another stellar month for equity performance as the S&P 500 was up +3.2% and has finished higher in 6 of 7 months in 2023. The tech heavy Nasdaq faired even better, up over +4.0% for the month. Small caps outperformed large caps for the 2nd consecutive month and are now up +14.7% YTD as financials showed some signs of recovery and were up +13.8% in July. Small cap energy stocks are up +26.8% over the last two months as oil prices are up almost +20% over that time.

- Credit risk continues to pay in 2023 as high yield bonds and EM debt pushed +1.4% and +3.0% higher in July. Intermediate and long-term treasuries were lower as yields rose across the curve, but short-term treasuries (1-3 years) were slightly positive for the month.

- The Federal Reserve raised its benchmark rate 25 basis points at the end of July to an upper bound of 5.50%. This is the highest level for the Fed Funds rate in 22 years. The annual change for headline CPI slowed to +3.0% from +4.0% in May. That marked the slowest rate of inflation since March 2021. This was below estimates of +3.1% and current estimates for July are +3.2%. Core CPI came in below estimates as well at +4.8% vs. +5.0% estimated and +5.3% in the prior month.

- The US economy grew +2.4% on an annualized basis for Q2. That came in higher than the +2.0% growth experienced in Q1 and was well above the +1.8% rate predicted by economists. Growth was propelled higher by strong business investment and consumer spending and saw a smaller detraction from the housing sector than in previous quarters. The US employment data for July was a mixed bag as payroll growth was slightly lower than expected at +187k and the previous two readings were revised -49k lower. However, wage growth was greater than forecasted at +0.4% MoM and +4.4% YoY, while the unemployment rate was lower than projected at 3.5% due to a +268k increase in household employment.

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved. Returns over one year have been annualized.

Source — Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices.

Disclosures

Past Performance Is No Guarantee of Future Performance. Any opinions expressed are current only as of the time made and are subject to change without notice. This report may include estimates, projections or other forward-looking statements, however, due to numerous factors, actual events may differ substantially from those presented. The graphs and tables making up this report have been based on unaudited, third-party data and performance information provided to us by one or more commercial databases. Additionally, please be aware that past performance is not a guide to the future performance of any manager or strategy, and that the performance results and historical information provided displayed herein may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Therefore, it should not be inferred that these results are indicative of the future performance of any strategy, index, fund, manager or group of managers. While we believe this information to be reliable, Pathstone bears no responsibility whatsoever for any errors or omissions. Index benchmarks contained in this report are provided so that performance can be compared with the performance of well-known and widely recognized indices. Index results assume the re-investment of all dividends and interest. Moreover, the information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or advice to purchase or sell any security, investment, or portfolio allocation. Any investment advice provided by Pathstone is client specific based on each clients’ risk tolerance and investment objectives. This presentation is not meant as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s accounts should or would be handled, as appropriate investment decisions depend upon the client’s specific investment objectives.

U.S. Large Cap Equity is represented by the S&P 500 Index, with dividends reinvested. U.S. Small Cap Equity is represented by the Russell 2000 Index. Developed Non-U.S. Equity is represented by the MSCI EAFE Index. Emerging Market Equity is represented by the MSCI EM Index. Real Estate is represented by the S&P Global Property Index. Commodities are represented by the Bloomberg Commodity Index. Natural Resource Equities are represented by the S&P North American Natural Resources Index. U.S. High Yield Debt is represented by the Bloomberg Barclays U.S. Corporate High Yield Index. Emerging Market Debt is represented by the JPM GMI-EM Global Diversified Index. U.S. Aggregate Bonds is represented by the Bloomberg Barclays U.S. Aggregate Bond Index. U.S. Treasuries is represented by the Bloomberg Barclays U.S. Treasury Index. U.S. Municipal Bonds is represented by the Bloomberg Barclays Municipal 1-10yr Index.