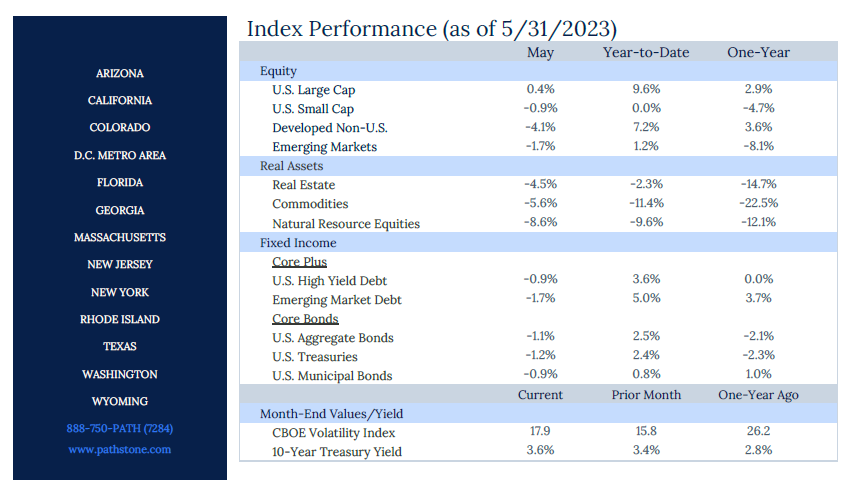

In May, US Large Cap stocks were propelled higher on AI news and a debt ceiling deal being struck. The S&P 500 was up +0.4% and Nasdaq was up nearly +6% MoM. Growth stocks, including tech, telecom, and consumer discretionary, continued their YTD outperformance. Developed ex-US Large Cap stocks fell -4.1%, but are still up over +7% YTD. Inflation has slowed marginally, but recent readings remain elevated. Payrolls were unexpectedly high, with 339,000 jobs created, but the unemployment rate rose to 3.7%. The Household Survey revealed a rise in joblessness.

Key Takeaways

- In May, US Large Cap stocks broke away from the pack as Artificial Intelligence news took center stage. The S&P 500 was up +0.4% month-over-month and +9.6% year-to-date. The tech heavy Nasdaq was up almost +6% MoM and up +24% YTD. Growth stocks extended their YTD outperformance in May, with tech, telecom, and consumer discretionary all up, while all other sectors were down, including the energy sector, which was down more than -10%.

- Developed ex-US Large Cap stocks fell -4.1% in May but are still up more than +7% YTD. European equities were down -5.9% for the month, while Japanese equities were up closer to +1.9%. In May, Emerging Market stocks fell -1.7% as Chinese equities fell -8.4%.

- On a year-over-year basis, inflation has slowed marginally for both core and headline. However, recent month-over-month readings continue to come in at elevated levels. As 2022s heightened levels are removed from the calculation, headline CPI is projected to fall to 4.1% from 4.9% in May.

- Payrolls surprised again in May, with 339,000 jobs created vs. 195,000 expected. However, the unemployment rate rose to 3.7% from 3.5% even as the labor force participation rate stayed flat. The Household Survey, which simply asks respondents if they are working or not, revealed a rise in the number of persons reporting being jobless.

- After considerable tentativeness, the US Senate approved an agreement negotiated by President Biden and Speaker McCarthy. As fears of a government default fade, all eyes turn to the Fed and its forthcoming June meeting. Fed officials have hinted at a rate pause, but solid job growth and disappointing inflation statistics have driven yields higher in May, as has the likelihood of another rate rise. The US banking crisis among other factors, according to Powell, might limit the size of any future rate hikes.

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved. Returns over one year have been annualized.

Source — Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices.

Please see PDF for important disclosures.