Equity markets started the month of November strong, but ended on a down note, as fears of a new Covid-19 variant (Omicron) and inflation overshadowed good news on the economy and passing of the jobs act. Equities, Real Assets, and riskier bonds were all down for the month as volatility spiked and the yield curve flattened. Investors flocked to safety as U.S. Treasuries had one of their best months of the year.

Key Takeaways:

- Equity markets faltered in November after news of higher than anticipated inflation (6.2% YoY) and a new Covid-19 variant (Omicron). This led to increased market volatility and a flattening of the yield curve. As a result, U.S. Treasuries had one of their best months of 2021. After a dramatic run, commodity prices have retreated. The price of oil dropped with news of Omicron and the U.S. tapping into their strategic oil reserves.

- Congress passed the Infrastructure and Jobs Act earlier this month and The House passed the $2 trillion social spending and climate bill where it will move on to the Senate. Jerome Powell has been nominated for a second term as Fed Chair and he announced that tapering might have to speed up as soon as mid-December.

- The FDA cleared Moderna and Pfizer Covid-19 boosters for all adults and the CDC has recommended adults to get it as soon as possible due to the potential spread of the Omicron variant. Jobless claims hit a 52-year low in November, coming in at under 200,000. Household spending increased as consumers have yet to be deterred by higher prices. However, while spending is up, Consumer Sentiment has been edging lower all year.

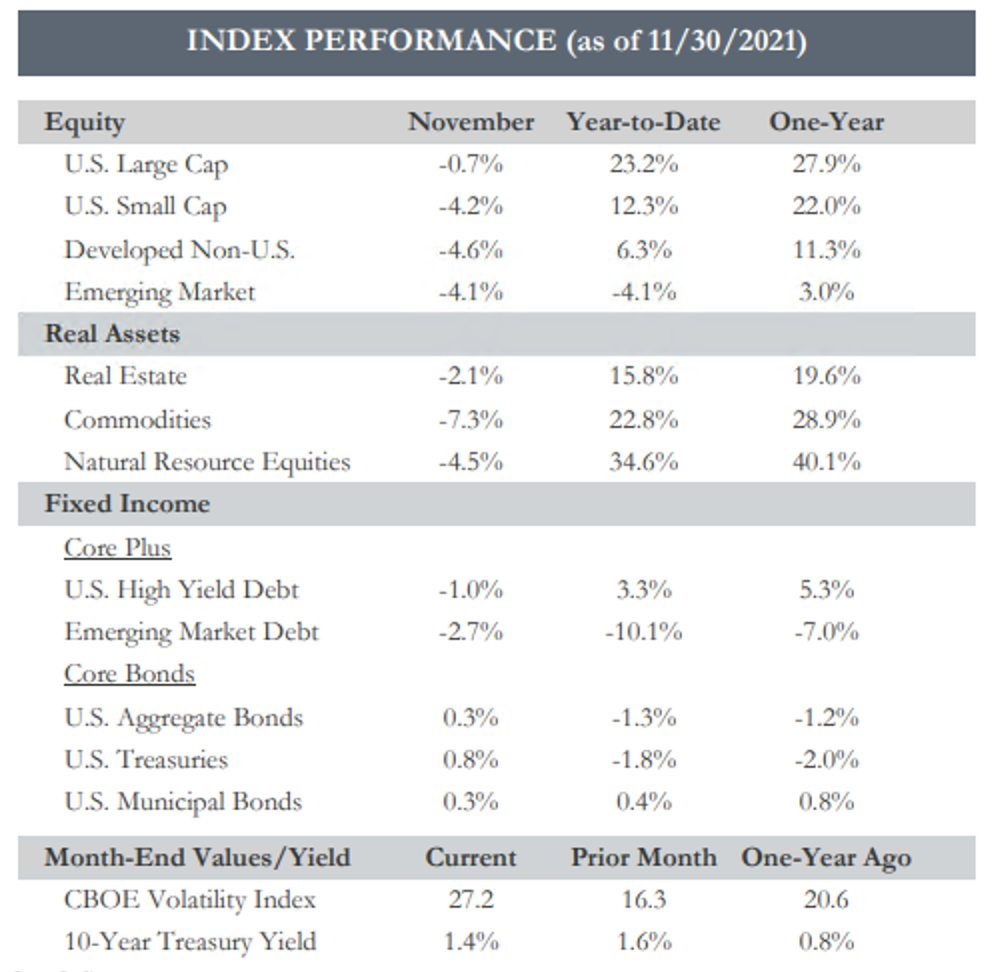

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved. Returns over one year have been annualized.

Source — Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices.