November’s financial markets painted a picture of robust economic resilience, with the S&P 500 triumphantly crossing the 6,000-point milestone. Consumer Confidence hit a 10-month peak, bolstered by optimistic job market perceptions and strong retail sales that demonstrated remarkable economic strength despite lingering uncertainties. Inflation settled at a modest 2.6% year-over-year, with Federal Reserve Chair Jay Powell describing the economy’s performance as “remarkably good” and signaling a measured approach to potential interest rate adjustments. Global markets experienced notable shifts, with the US Dollar strengthening and international equities recalibrating in response to potential policy changes under a new administration.

Key Takeaways

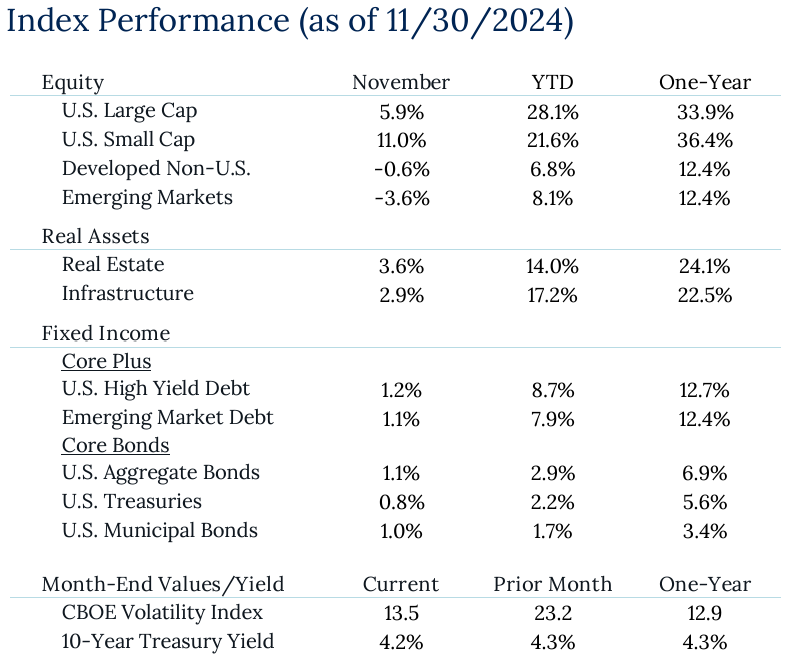

- Market News: The November economic landscape presented a nuanced picture of resilience and cautious optimism, with the S&P 500 crossing the 6,000-point threshold. The index’s 5.9% monthly return, with strong performances in sectors like Consumer Discretionary (13.3%) and Financials (10.3%), underscored the underlying investor optimism.

- Sentiment: Consumer confidence reached a 10-month high in November, reflecting growing optimism about job availability and economic prospects. This sentiment indicator, combined with retail sales rising more than forecast, suggests consumers remain financially strong despite ongoing economic uncertainties.

- Inflation & Monetary Policy: US inflation (CPI) rose to 2.6% YoY in October, aligning with economists’ expectations. Fed Chair Jay Powell emphasized the economy’s “remarkably good” performance, indicating minimal urgency to rapidly lower rates, which provided markets with a sense of stability and predictive clarity about future monetary interventions.

- Int’l Markets: The US Dollar strengthened considerably post-election and international equites broadly sold off. European large caps and small caps were down about -1.5% and Chinese equities were down -4.4%. Investors rapidly adjusted their portfolios, pricing in potential policy implications of the new administration’s anticipated economic approach.

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved. Returns over one year have been annualized.

Source — Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices.

Disclosures

Past Performance Is No Guarantee of Future Performance. Any opinions expressed are current only as of the time made and are subject to change without notice. This report may include estimates, projections or other forward looking statements, however, due to numerous factors, actual events may differ substantially from those presented. The graphs and tables making up this report have been based on unaudited, third-party data and performance information provided to us by one or more commercial databases. Additionally, please be aware that past performance is not a guide to the future performance of any manager or strategy, and that the performance results and historical information provided displayed herein may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Therefore, it should not be inferred that these results are indicative of the future performance of any strategy, index, fund, manager or group of managers. While we believe this information to be reliable, Pathstone bears no responsibility whatsoever for any errors or omissions. Index benchmarks contained in this report are provided so that performance can be compared with the performance of well-known and widely recognized indices. Index results assume the re-investment of all dividends and interest. Moreover, the information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or advice to purchase or sell any security, investment, or portfolio allocation. Any investment advice provided by Pathstone is client specific based on each clients’ risk tolerance and investment objectives. This presentation is not meant as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s accounts should or would be handled, as appropriate investment decisions depend upon the client’s specific investment objectives.

U.S. Large Cap Equity is represented by the S&P 500 Index. U.S. Small Cap Equity is represented by the Russell 2000 Index. Developed Non-U.S. Equity is represented by the MSCI EAFE Index. Emerging Market Equity is represented by the MSCI EM Index. Real Estate is represented by the FTSE NAREIT Index. Infrastructure is represented by the FTSE Global Core Infrastructure 50/50 Index. U.S. High Yield Debt is represented by the Bloomberg Barclays U.S. Corporate High Yield Index. Emerging Market Debt is represented by the Bloomberg EM USD Aggregate Index. U.S. Aggregate Bonds is represented by the Bloomberg Barclays U.S. Aggregate Bond Index. U.S. Treasuries is represented by the Bloomberg Barclays U.S. Treasury Index. U.S. Municipal Bonds is represented by the Bloomberg Barclays Municipal 1-10yr Index.