Key Takeaways:

- After approaching September’s all-time high early in the month, elusive fiscal stimulus, increasing virus numbers, and election jitters all converged to test investor sentiment pulling the S&P 500 lower in October.

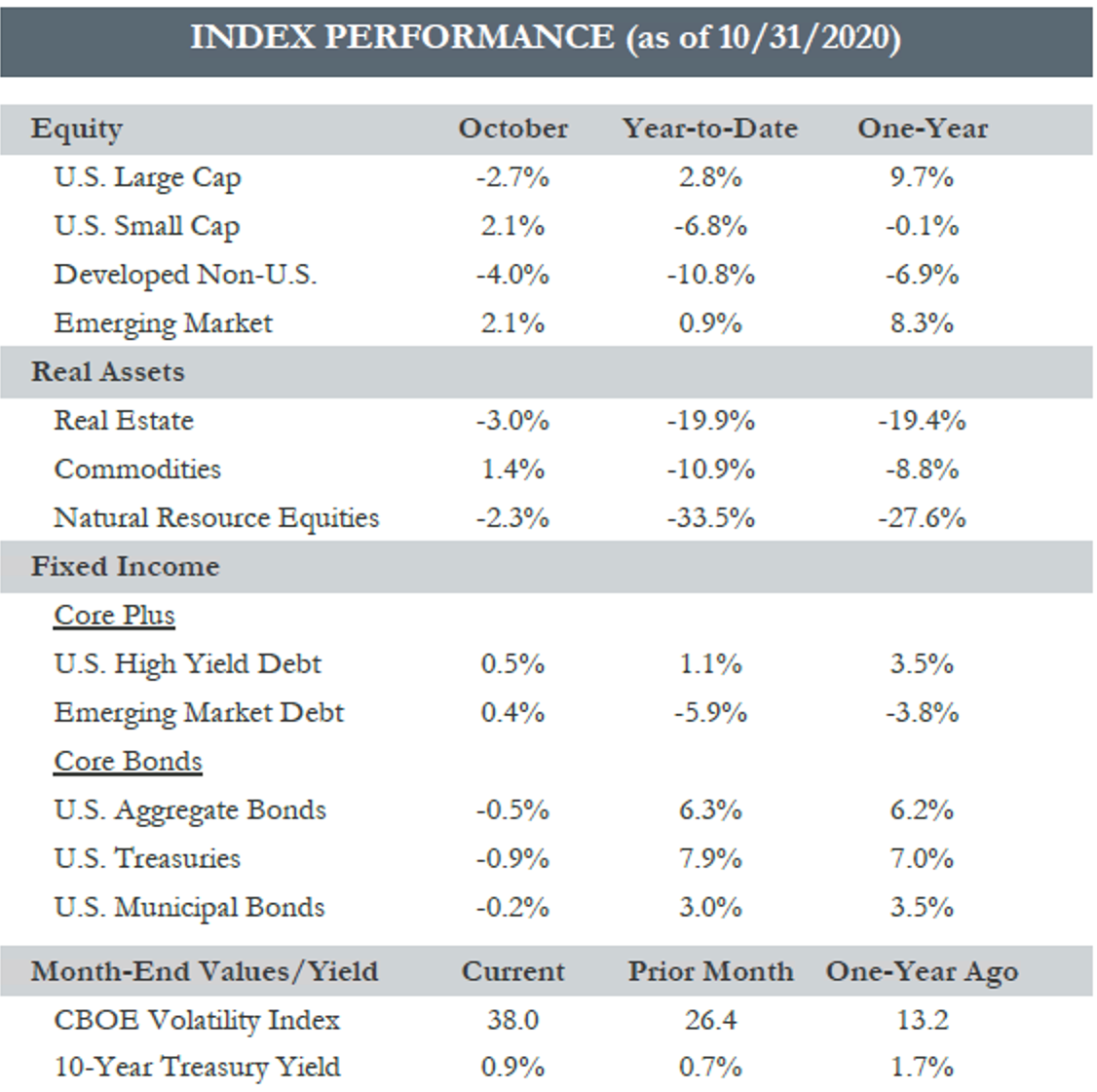

- A relatively positive earnings season was not enough to overcome these near-term worries. Despite the uneasy mood, treasury yields ticked higher, with the 10 year Treasury yield climbing to the highest levels since early June, as investors did not rush into typical safe-havens reflecting the absence of widespread panic.

- U.S. Small Cap and Emerging Market equities advanced, while Developed Non-U.S. equities ended the month lower due to several European countries experiencing increasing virus cases and implementing new lockdown measures.

- Q3 was the best quarter for GDP growth in post-World War II history, a nice turnaround after Q2’s worst quarterly contraction on record. Looking beyond these wild swings, the focus should be on the economy working down the path to recovery, even if this rapid pace is expected to slow.

- Elections and ongoing political uncertainty may be here to stay, but the stimulus and vaccine headlines will likely dictate the market’s direction over the next several months.

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved.

Source — Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices.

Please see important disclosures in the PDF version of this article.