Markets surged in Q3, fueled by the first rate cut of the cycle. This pivotal shift sparked a remarkable rotation, with previously overlooked assets stealing the spotlight. REITs, small caps, value stocks, and international markets outperformed. The weakening US Dollar propelled international markets and expansionary monetary and fiscal policy measures sent Chinese equities soaring over 20% for the quarter. Gold shone brightly as well, reaching new highs, though oil sold off on weakening demand. Bond performance was back in a big way as yields dipped and the once written off “60/40” portfolio is up double digits in 2024. The US economy is on solid footing after enduring years of high inflation and appears to be on track to achieve the Fed’s coveted soft landing scenario as inflation has cooled but economic growth has remained on trend.

Key Takeaways

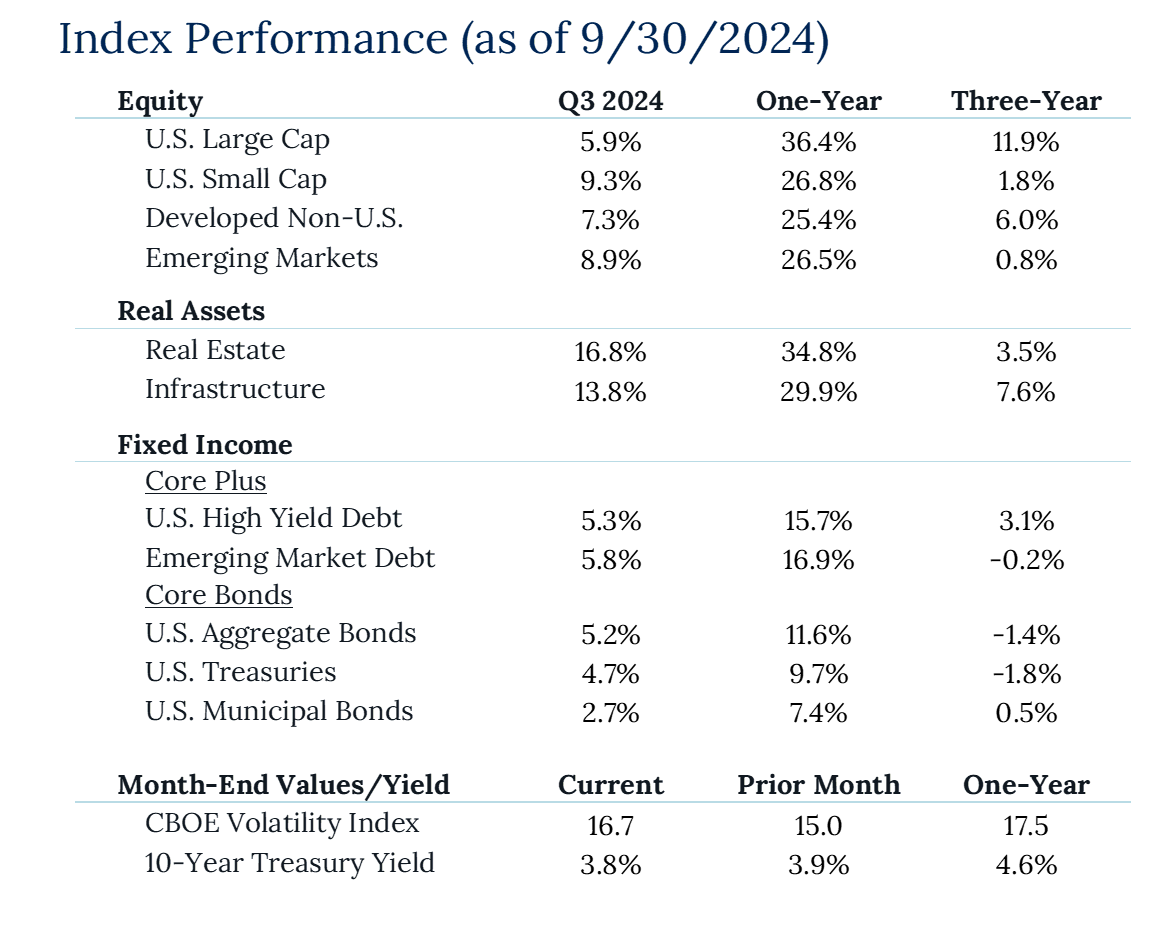

- Market Rotation: The first rate cut of the cycle boosted markets and sparked a significant rotation. Interest-rate sensitive and previously overlooked assets gained favor, with small caps, international markets, and value stocks outperforming. REITs and infrastructure saw substantial gains, while longer-term bonds outpaced short-term bonds.

- International Equities: Lower rates and a weakening US Dollar led to impressive gains in international markets for Q3. Developed markets showed strong performance as European and Japanese equities were up +6.6% and +5.7%. Small caps were the standout performers, posting a remarkable 10.7% gain. Emerging markets also thrived, with Chinese equities soaring 23.5% due to expansionary monetary and fiscal policy measures

- Commodities: Gold reached new highs in Q3, climbing 13% for the quarter and an impressive 42% over the past year. Oil and natural gas prices, however, declined by 12% and 10% respectively, leading to lower consumer energy costs but potentially signaling weakening demand, especially in China.

- Bond Market Revival: The lower yield environment in Q3 breathed new life into bond markets. Emerging Market debt, High Yield, Investment Grade Corporates, and Treasuries, all posted gains exceeding 5% for the quarter. Over the past year, these sectors have delivered double-digit returns, marking a significant turnaround in fixed income performance.

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved. Returns over one year have been annualized.

Source — Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices.

Disclosures

Past Performance Is No Guarantee of Future Performance. Any opinions expressed are current only as of the time made and are subject to change without notice. This report may include estimates, projections or other forward looking statements, however, due to numerous factors, actual events may differ substantially from those presented. The graphs and tables making up this report have been based on unaudited, third-party data and performance information provided to us by one or more commercial databases. Additionally, please be aware that past performance is not a guide to the future performance of any manager or strategy, and that the performance results and historical information provided displayed herein may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Therefore, it should not be inferred that these results are indicative of the future performance of any strategy, index, fund, manager or group of managers. While we believe this information to be reliable, Pathstone bears no responsibility whatsoever for any errors or omissions. Index benchmarks contained in this report are provided so that performance can be compared with the performance of well-known and widely recognized indices. Index results assume the re-investment of all dividends and interest. Moreover, the information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or advice to purchase or sell any security, investment, or portfolio allocation. Any investment advice provided by Pathstone is client specific based on each clients’ risk tolerance and investment objectives. This presentation is not meant as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s accounts should or would be handled, as appropriate investment decisions depend upon the client’s specific investment objectives.

U.S. Large Cap Equity is represented by the S&P 500 Index, with dividends reinvested. U.S. Small Cap Equity is represented by the Russell 2000 Index. Developed Non-U.S. Equity is represented by the MSCI EAFE Index. Emerging Market Equity is represented by the MSCI EM Index. Real Estate is represented by the FTSE NAREIT Index. Infrastructure is represented by the FTSE Global Core Infrastructure 50/50 Index. U.S. High Yield Debt is represented by the Bloomberg Barclays U.S. Corporate High Yield Index. Emerging Market Debt is represented by the Bloomberg EM USD Aggregate Index. U.S. Aggregate Bonds is represented by the Bloomberg Barclays U.S. Aggregate Bond Index. U.S. Treasuries is represented by the Bloomberg Barclays U.S. Treasury Index. U.S. Municipal Bonds is represented by the Bloomberg Barclays Municipal 1-10yr Index.