“Spooky action at a distance” is the concise, comprehensive, and accessible phrase used by Albert Einstein in the early twentieth century to describe entanglement, a key principle of quantum mechanics, where subatomic particles can interact in complex, bizarre, and random ways. And today, just 100 or so years later, the race for the edge in developing and deploying computing based on quantum principles is running full throttle.”

This evolution beyond Newtonian classical mechanics is leading to the creation of arguably the most disruptive and transformative technology in history. In quantum mechanics, an object can exist in several states simultaneously; applying these principles to computing offers the potential to analyze a multitude of data points and scenarios simultaneously in order to solve complex challenges well beyond humankind’s current capacity.

Why does this matter for investors?

How could it not? Quantum computing may literally shift the current world order. The E.U., the U.S., China, and Japan are the nations investing most heavily in quantum computing research and development, with China’s stated commitment dwarfing the rest – with potentially meaningful implications for the balance of global power.

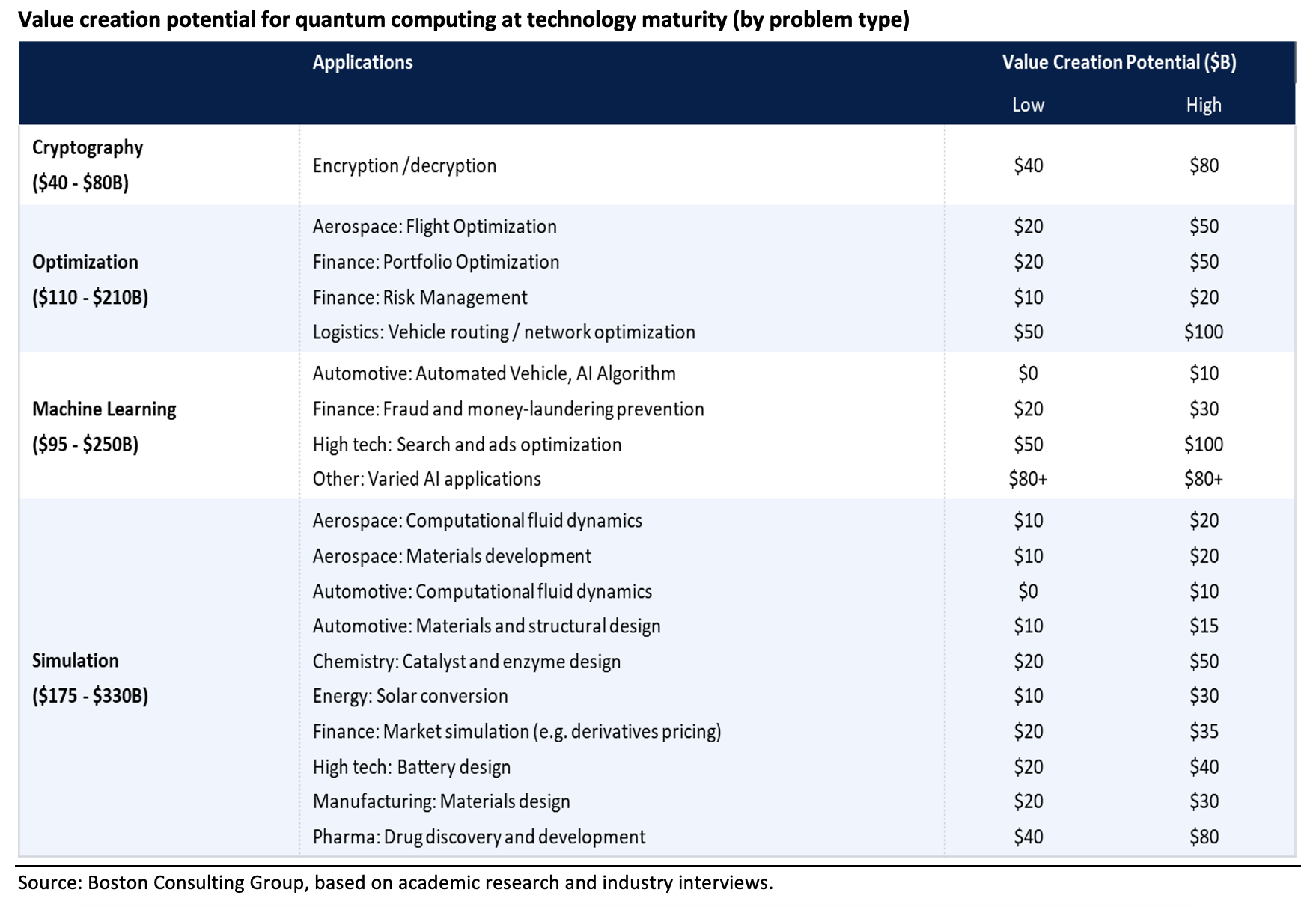

Looking beyond geopolitics, leading private sector enterprises are investing in demonstrations of “quantum supremacy” and creating roadmaps to practical use cases. The likes of IBM, Alphabet, Amazon, Goldman Sachs, Pfizer, Lockheed Martin, Mercedes-Benz and Microsoft, among others, are setting the stage to reimagine the competitive landscape. As we explore in this report, quantum computing will affect industries ranging from asset management to transportation as they seek to solve challenges that tend to fall into defined “problem types”: encryption/decryption, optimization, machine learning, and simulation. A July 2021 report from Boston Consulting Group estimates the value creation potential from such developments in the many billions, as shown in the table that follows.

About This Report

Pathstone has created this collaborative research report to offer insight into the potential scope of quantum-driven transformation, how it may affect the future investment landscape from both the macro and sector perspectives, and its potential to do so in a way that sustains humankind and heals our planet as outlined in the UN Sustainable Development Goals (SDGs).

As an investment advisor, one of Pathstone’s core services is to identify investment strategies that align with our clients’ goals and needs. Integral to that effort is identifying asset managers who continually seek predictive insight, who can “look around the corner” and understand the whole system in which their industries and companies operate. The analysis we offer in this report is intended to challenge asset managers and investors to consider how a dramatically shifting technological landscape could affect geopolitics, the global investment landscape, and their portfolios as a new quantum world emerges.

To learn more and access the full report, “Quantum Impact — The Potential for Quantum Computing to Transform Everything,” click here.

Please see the PDF version of the full report for important disclosures.