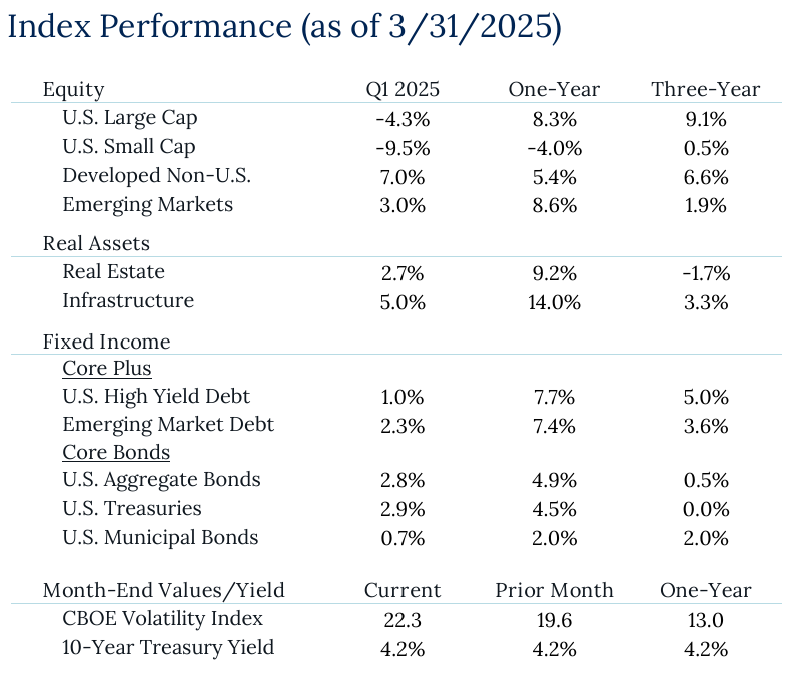

While domestic growth stocks faltered significantly in the first quarter, European and Chinese equities delivered their strongest comparative performance in decades. Real assets proved to be a bright spot with impressive gains across commodities, metals, and infrastructure. Meanwhile, economic uncertainty grows under new trade policies, despite resilient employment numbers. Though some underlying fundamentals remain positive, waning consumer confidence and rising inflation expectations present notable headwinds for investors navigating this complex landscape.

Key Takeaways

- Growth Struggles: US Large Cap performance suffered due to growth stock weakness, with the Russell 1000 Growth Index down -10% and the Magnificent 7 falling -16% for the quarter. Energy stocks emerged as sector leaders with over 10% gains, while Technology and Consumer Discretionary sectors lagged significantly, each declining more than 10%.

- International Strength: International equities delivered exceptional performance relative to US markets, marking one of the best comparative quarters since the early 2000s. European equities achieved their strongest relative performance since the mid-1980s, rising 10.5%, while Chinese equities surged 15%. This outperformance was supported by a nearly 4% depreciation in the dollar index during Q1.

- Small Cap Challenges: US Small Caps endured another disappointing quarter, contributing to the worst month of combined performance with US Large Caps since September 2022. Meanwhile, implied market volatility stands nearly double than where it was at this point last year, reflecting ongoing investor uncertainty.

- Real Asset Rally: Commodities and other real assets delivered impressive returns in Q1, with broad commodities gaining nearly 9%, gold surging 18%, and copper jumping over 25%. REITs and infrastructure also performed well, rising 2.75% and 5% respectively, while TIPs outperformed non-inflation protected treasuries and were up 4.2% for the quarter as re-inflation fears rose.