Over this past year, Pathstone’s Wealth Planning Group has refined and expanded how we work with clients. We have always strived to deliver technically excellent estate, financial, and tax planning solutions, and we remain committed to this goal. This past year, we have enhanced our support for families on the qualitative and emotional elements of living with substantial wealth – the human side.

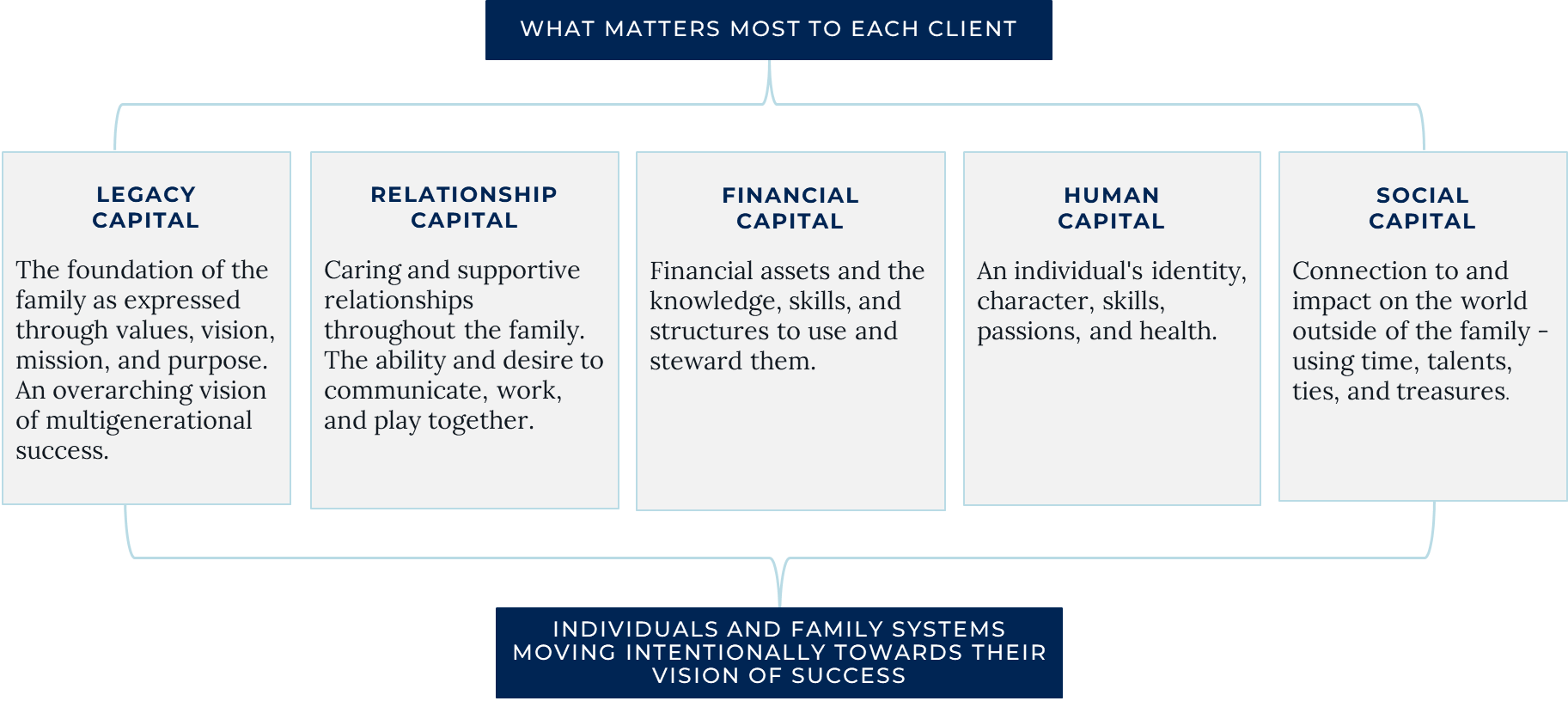

To reflect our heightened focus on integrating the full range of elements that contribute to true wealth, we have structured our service offering around five types of capital that for many families define individual and family thriving:

- Legacy Capital: The foundation of the family as expressed through values, vision, mission, and purpose. We help families articulate shared values, define the purpose of their money, and build lasting cohesion through family story telling.

- Relationship Capital: The ability and desire to communicate, work and play together with caring and supportive relationships. We help families figure out leadership succession, work together across generations and develop right-sized governance (decision making and structures) that reflect the family’s culture.

- Financial Capital: Financial assets and the knowledge, skills and structures to use and steward it. We help families align their goals for thriving and their estate plans, gift with confidence (and tax efficiency), and address the emotional impact of inheriting.

- Human Capital: An individual’s identity, character, skills, passions and health. We help parents navigate raising kids in an unfamiliar financial reality, Rising Gens find their voice, and family members move gracefully from one life stage to the next.

- Social Capital: Connections to and impact on the world outside of the family – using time, talents, ties and treasures. We help families pursue impact in ways that reflect the best of who they are, whether developing large-scale foundation strategies or bringing greater intimacy to family philanthropy.