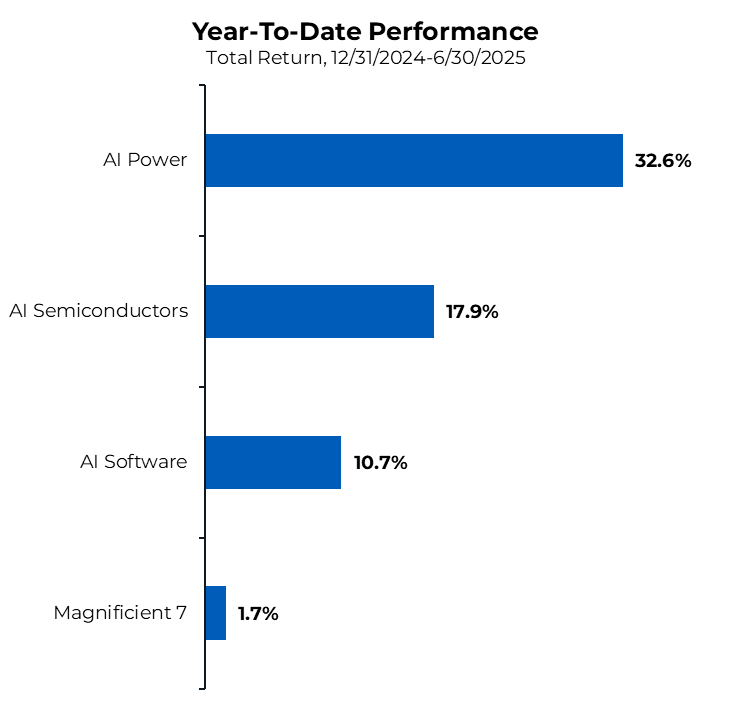

Tech investors tend to focus on the largest and most well-known companies, the so-called Magnificent 7.1 However, beneath the surface, a more nuanced story is playing out. Small and mid-sized growth companies have been generating impressive earnings growth and are often trading at more reasonable valuations than their larger peers.2 But why have these companies lagged behind their larger counterparts, and where are the next major growth opportunities?

To explore these questions, Pathstone’s Michael McGowan, Head of Investment Strategy, recently sat down with Jim Robillard, Founder and Chief Investment Officer of Spyglass Capital Management, to discuss the future of artificial intelligence (AI) and humanoid robotics.

The case for small and mid-caps

The conversation delved into the often-overlooked potential of small and mid-cap growth companies, which have been generating strong earnings growth and are frequently trading at more reasonable valuations compared to their larger counterparts. Michael suggested that the concentration of capital in the largest technology companies, known as the Magnificent 7, has created a mispricing opportunity in the small and mid-cap space. “The market’s focus on the Magnificent 7 has left a lot of smaller, innovative companies undervalued,” he noted.