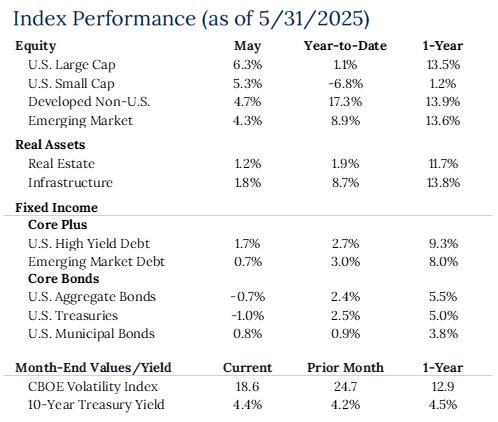

Markets bounced back in May, with U.S. equities ending a three-month losing streak and the Magnificent 7 delivering their best monthly gains in two years. U.S. equities have rebounded from the recent selloff, pushing the S&P 500 back into positive territory with a 1.1% gain on the year. After a string of stellar months, international equities have outperformed U.S. equities year-over-year, boosted by a weaker dollar. In fixed income, corporates outpaced Treasuries as spreads narrowed, and short duration performed well despite a sharp 30 basis point rise in the 2-year Treasury yield. Meanwhile, focus shifted from tariffs to fiscal concerns, as President Trump’s “One Big Beautiful Bill” stoked debate over national debt, driving inflation expectations, interest rates, and U.S. dollar volatility higher.

Key Takeaways

- Market News: U.S. equities snapped a three-month losing streak, with both large and small caps posting solid gains. The Magnificent 7 delivered their best monthly performance in two years as growth outperformed value. U.S. stocks have rebounded from the recent selloff, and the S&P 500 now shows a modest gain of 1.1% YTD.

- International Equities: Developed International equities continued their strength this year, supported by a weakening U.S. dollar. Emerging markets also rallied, driven by a surge in semiconductor stocks. On a 12-month basis, both Developed International and Emerging Markets are outperforming the S&P 500, something not seen since October 2023 and, before that, April 2018.

- Fixed Income: Treasuries lagged corporates as credit spreads tightened, though they’re still having their strongest start to a year since 2020. Short duration outperformed, even as the 2-year Treasury yield jumped 30 basis points, its second-largest move higher since the first rate cut in September.

- Fiscal Policy: While tariffs dominated headlines, attention turned toward President Trump’s proposed “One Big Beautiful Bill.” Though not yet finalized, the plan has raised concerns about rising debt levels, contributing to higher inflation expectations, upward pressure on rates, and renewed scrutiny of the U.S. dollar.