Key Takeaways:

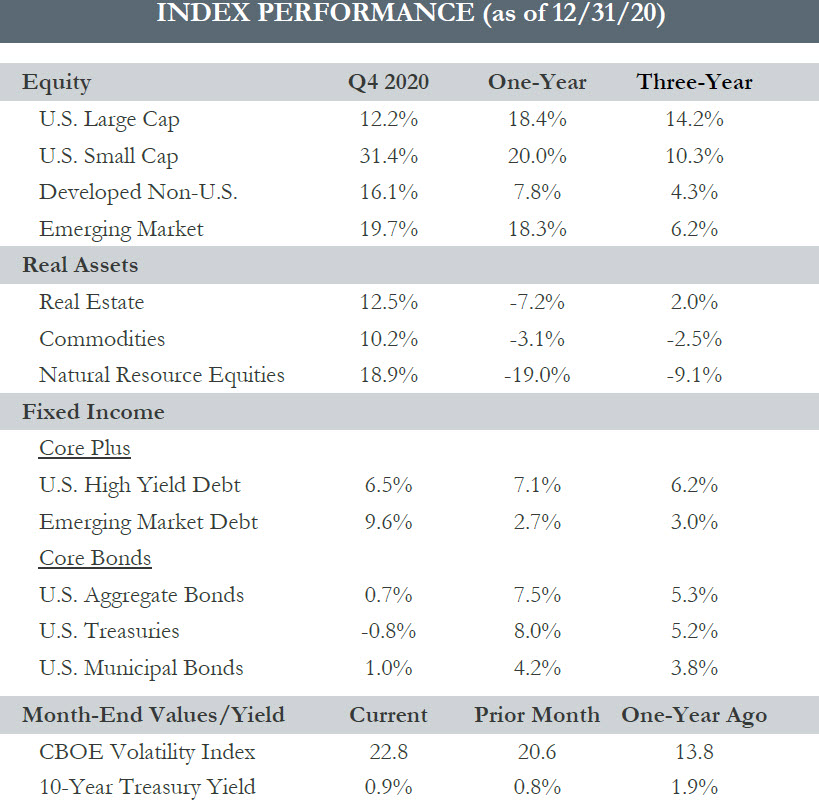

- Increasing virus numbers and slowing economic activity were not enough to derail the market’s positive momentum during the fourth quarter. 2020 turned out to be an impressive year for financial assets despite the pandemic.

- Successful vaccine trial results led risk assets to soar, providing investors some clarity on what is to come in 2021.

- On the surface, widespread gains masked the drivers of index performance. The leaders of Q4 were much different from the narrow breadth observed during the first half of the year, powered by a handful of technology-oriented growth companies.

- To round out the year, small caps dominated large caps, pushing the Russell 2000 Index ahead of the S&P 500. In the fourth quarter, value styles edged past growth, and non-U.S. assets outperformed U.S. Large Caps.

- Core fixed income returns were mixed as the yields on treasuries inched higher over the quarter, but not enough to offset another impressive year for the Bloomberg Barclays U.S. Aggregate Bond Index returning 7.5%.

- Another $900 billion of the stimulus should alleviate some of the near-term economic headwinds in the U.S. while vaccine distributions ramp up. Not to be overshadowed, Britain has officially left the EU, nearly four years after the original Brexit vote.

Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices.

Source — You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved. Returns over one year have been annualized.

Quarterly Commentary:

- We are all excited to close the books on 2020 and look ahead to what should be a “better” year—2021. But first, with any change of the calendar year, it’s important to reflect on where we’ve been and, as is the case with this past year, what we’ve overcome.

- 2020 brought a global pandemic, social distancing, historic levels of unemployment, a nearly 35% drop in the S&P 500, and a divisive Presidential election, just to name a few of the major hurdles we have faced over the past twelve months.

- On the flip side, the economy has also been supported by direct stimulus payments, increased unemployment benefits, a robust housing sector, resilient consumer spending, and historically low interest rates.

- The speed and magnitude of the fiscal and monetary response helped alleviate market stresses and supported the economy as it began recovering from the lockdown-induced shocks.

- Markets have been discounting a brighter outlook on the horizon, supported by vaccine news, elevated levels of household savings, ongoing fiscal and monetary support, and the pent-up demand to resume leisure and hospitality activities that should help accelerate the recovery for some of the hardest-hit industries once it is safe to do so.

- Over the next few months, the market will battle between the tug and pull of the immediate-term headwinds and the intermediate-term optimism. We will face plenty of challenges in the year ahead as we anxiously attempt to resume “normal” activity.

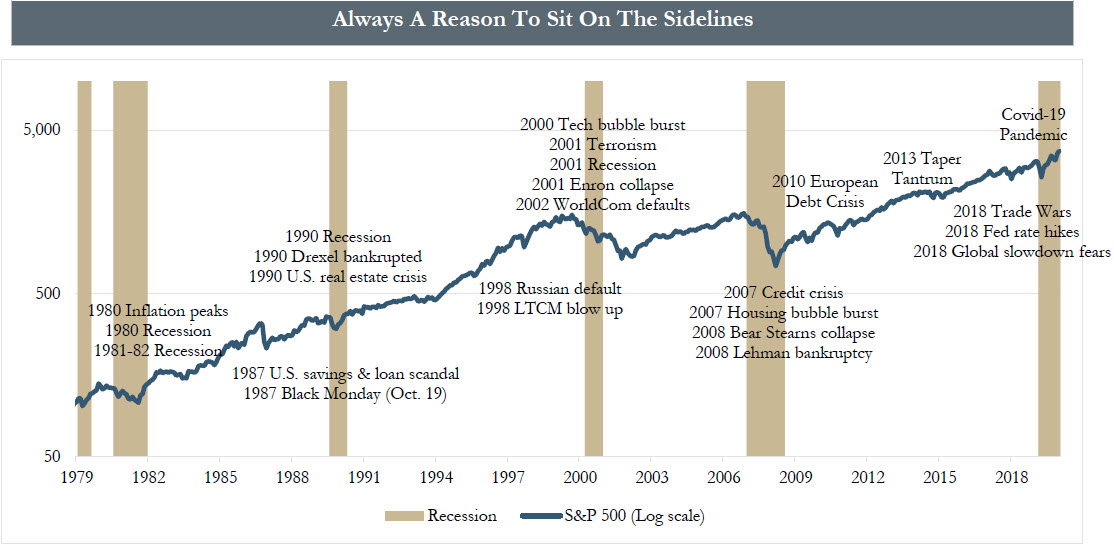

- As investors, we recognize that risks are always present, and there are always reasons to exercise caution. But markets don’t wait for the “all clear” signal, and our psychology can be a detriment when facing growing uncertainties.

- Investment success comes as much from inaction (not selling at the wrong time) as it does with action. Having a disciplined investment process and framework in place helps us increase the probability of successful outcomes.

Bloomberg

Source — You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved.

Please see the PDF version of this article for important disclosures.