While the global economy continues to reopen, we keep our sights set on developments related to several major themes: what comes next for the virus, whether inflation proves to be transitory, when the Fed will start to taper asset purchases, clarity on infrastructure spending and tax reform, and trade relations with China, just to name a few.

Key Takeaways:

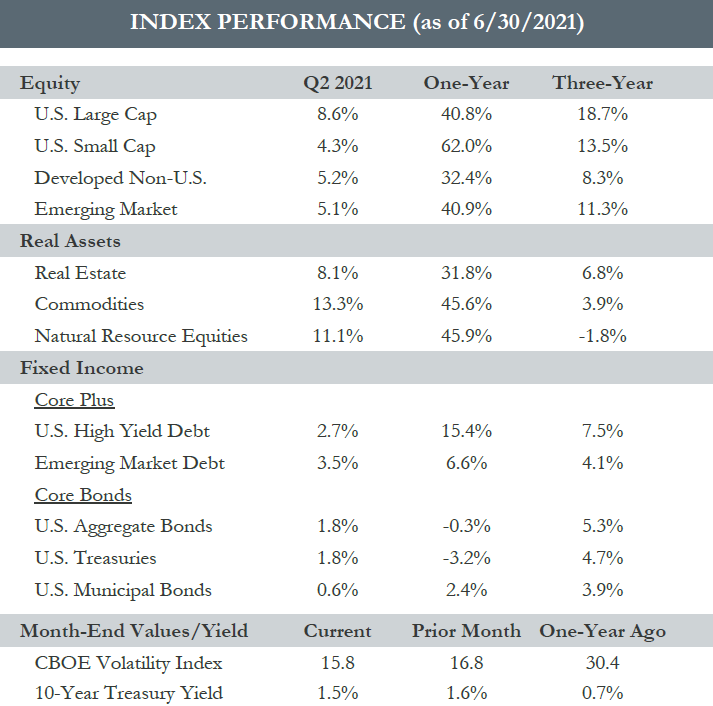

- Equities notched their fifth straight quarter in a row of gains, and the S&P 500 has returned an impressive 15% so far this year. Global economy continues to reopen and navigate life with growing vaccination efforts.

- Real assets benefitted from the reflation trade. Commodities and Natural Resource Equities rallied thanks to recovering global growth and rising inflation expectations.

- Core bonds had a positive quarter as interest rates declined over the past three months. However, on a trailing 12-month basis the U.S. Aggregate Bond Index return is slightly negative. Municipal bonds have fared better on a year-to-date and twelve-month basis, with slightly positive returns.

- Big strides on the reopening front have helped push the U.S. economy ahead of global peers. Easing restrictions and rising vaccinations in Europe should allow for a swift catchup as pent-up demand is unleashed.

- Mobility data remains positive with airline passengers and restaurant activity at the highest levels since lockdowns began. Consumers appear eager to make up for lost vacations and dinners out with spending patterns shifting back towards services.

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved. Returns over one year have been annualized.

Source — Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices.

Quarterly Commentary:

- Recovery trends are well underway as the global economy is in much better shape today than this time last year.

- After an impressive first six months of the year where risk assets continued to rally, investors now shift their focus towards what comes next.

- While there may be more questions than answers at this point in time, we keep our sights set on developments related to several major themes: what comes next for the virus, whether inflation proves to be transitory, when the Fed will start to taper asset purchases, clarity on infrastructure spending and tax reform, and trade relations with China, just to name a few.

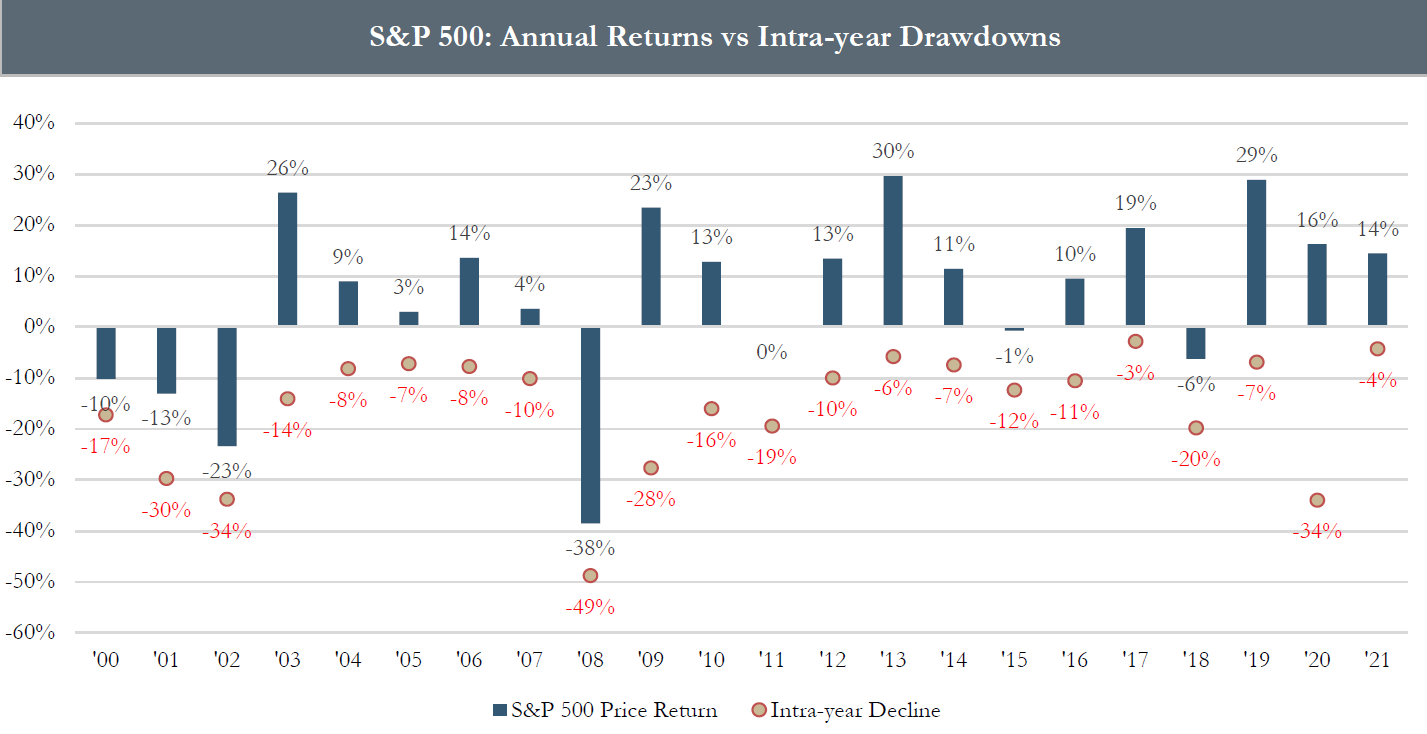

- Needless to say, it should not come as a surprise if and when volatility rears its head once again. Markets may undergo a correction as investors get skittish with equity markets sitting near all-time highs and questions circulate around how much of the positive news has already been baked into markets.

- Our U.S. Market Cycle Dashboard sits firmly in bullish territory indicating the likelihood of a recession over the near-term is minimal, and supports our view that economic growth should remain positive over the coming quarters. Consumer confidence is rising and retail sales show that consumers have been eager to spend. Wages and incomes for workers have been rising, which should further support consumption and businesses have a robust demand for labor, as represented by the record number of job openings.

- Nonetheless, intra-year corrections are normal and to be expected during the course of a bull market. Historically it is not unusual for markets to experience a significant decline, even when returns are positive over the full calendar year.

- Year-to-date the maximum drawdown for the S&P 500 is only 4%. However, from 2000 – 2020 the median intra-year decline has been around 12%, despite positive annual price returns in 14 of the 21 time periods.

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved.

Source — Bloomberg. Price return data. Calendar year 2021 represents return through 6/30/2021.

Please see the PDF version of this article for important disclosures.