The S&P 500 had its best start to a year since 2019, up +10.6%. After starting the year down nearly -4% in January, US Small Caps finished the quarter up +5.2%. Bond yields have mostly drifted higher so far in 2024 as the market now anticipates fewer rate cuts this year and the treasury announced record issuance.

Key Takeaways

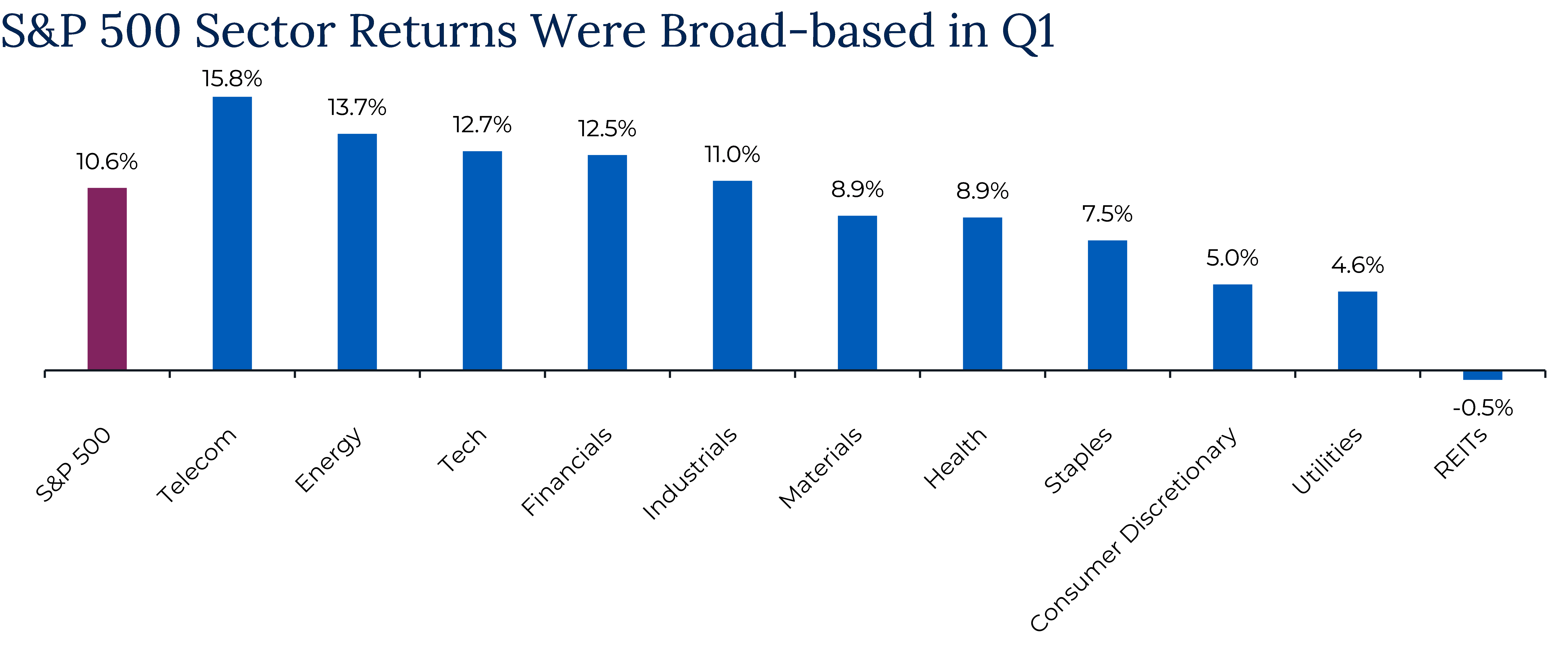

- Market News: The S&P 500 had its best start to a year since 2019, up +10.6%. Interesting to note that performance has been much more broad-based in 2024 than in 2023. Technology and telecom sectors are still performing very well, but energy, financials, and industrials were all up double-digits in Q1.

- Small Caps: After starting the year down nearly -4% in January, US Small Caps finished the quarter up +5.2%. Much of this year’s performance was driven by a few companies that investors have piled into to take advantage of popular themes such as AI and Bitcoin.

- Bonds: Yields have mostly drifted higher so far in 2024 as the market now anticipates fewer rate cuts this year and the treasury announced record issuance. Bond performance, outside of high yield, has been poor but yields remain at attractive levels and near 10-year highs.

- Commodities: One of the biggest stories recently has been gold hitting new all-time highs. This rally has ensued despite the appreciation of the US dollar and solid economic data. Oil prices have also risen in each of the first 3 months of the year and 18% overall. This has resulted in higher-than-expected inflation rates and increased expectations for the future. Natural Resource Equities have taken advantage of higher prices and are one of the top performers of the year. Energy stocks have proven to be a useful hedge against higher rates and inflation.

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved. Returns over one year have been annualized.

Source — Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices.

Quarterly Commentary

- Monetary Policy: The Fed left its benchmark rate unchanged at an upper bound of 5.5% and revised its Summary of Economic Projections which includes the “Dot-Plot.” The median Fed Funds rate estimate for the end of this year remained unchanged at 4.6%, though was one vote away from moving higher. The year-end estimates for 2025, 2026, and the longer run all moved higher, yet Fed Chair Jay Powell has reiterated that they are getting close to having the confidence to cut rates for the first time this cycle but will not commit to any path just yet.

- Inflation: While the general trajectory of inflation is heading lower, recent monthly readings have been hotter than anticipated at +0.3% for January and +0.4% for February. Recent readings have been affected by higher oil prices and it is becoming evident that it is going to take some time to get back to target. As of February, headline CPI sat at +3.2% and +3.8% for core. The Fed does not seem overly concerned about the path of inflation as their estimates barely moved in March and are still projecting multiple rate cuts this year.

- Labor Market: The US economy has added an average of 276k jobs every month so far this year and the unemployment rate has been below 4% for 26 consecutive months, which is the 3rd longest streak on record. It is worth noting that wage growth has been slowing down since the summer of 2022. Inflation can continue to cool and jobs can continue to be added to the economy so long as wage growth is on a path towards long-term trend.

- US Economy: A couple of key macro indicators broke losing streaks in Q1, highlighting how resilient the US economy has been in the past few years. Leading Economic Indicators, according to the Conference Board, fell for 23 consecutive months until February and the Institute for Supply Management’s manufacturing survey spent 16 months in contractionary territory until March. Additionally, the median Bloomberg estimate for Q1 real GDP growth is +2.0% QoQ annualized, with some estimates as high as +3.2%, and the 2024 calendar year estimate has risen to +2.2% from +0.6% last August. The US economy has absorbed higher rates and price levels beyond what most economists believed possible.

You cannot invest directly in an index; therefore, performance returns do not reflect any management fees. Returns of the indices include the reinvestment of all dividends and income, as reported by the commercial databases involved. Returns over one year have been annualized.

Source — Bloomberg, Morningstar, treasury.gov. S&P Dow Jones Indices.

Disclosures

Past Performance Is No Guarantee of Future Performance. Any opinions expressed are current only as of the time made and are subject to change without notice. This report may include estimates, projections or other forward looking statements, however, due to numerous factors, actual events may differ substantially from those presented. The graphs and tables making up this report have been based on unaudited, third-party data and performance information provided to us by one or more commercial databases. Additionally, please be aware that past performance is not a guide to the future performance of any manager or strategy, and that the performance results and historical information provided displayed herein may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Therefore, it should not be inferred that these results are indicative of the future performance of any strategy, index, fund, manager or group of managers. While we believe this information to be reliable, Pathstone bears no responsibility whatsoever for any errors or omissions. Index benchmarks contained in this report are provided so that performance can be compared with the performance of well-known and widely recognized indices. Index results assume the re-investment of all dividends and interest. Moreover, the information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or advice to purchase or sell any security, investment, or portfolio allocation. Any investment advice provided by Pathstone is client specific based on each clients’ risk tolerance and investment objectives. This presentation is not meant as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s accounts should or would be handled, as appropriate investment decisions depend upon the client’s specific investment objectives.

U.S. Large Cap Equity is represented by the S&P 500 Index, with dividends reinvested. U.S. Small Cap Equity is represented by the Russell 2000 Index. Developed Non-U.S. Equity is represented by the MSCI EAFE Index. Emerging Market Equity is represented by the MSCI EM Index. Real Estate is represented by the S&P Global Property Index. Commodities are represented by the Bloomberg Commodity Index. Natural Resource Equities are represented by the S&P North American Natural Resources Index. U.S. High Yield Debt is represented by the Bloomberg Barclays U.S. Corporate High Yield Index. Emerging Market Debt is represented by the JPM GMI-EM Global Diversified Index. U.S. Aggregate Bonds is represented by the Bloomberg Barclays U.S. Aggregate Bond Index. U.S. Treasuries is represented by the Bloomberg Barclays U.S. Treasury Index. U.S. Municipal Bonds is represented by the Bloomberg Barclays Municipal 1-10yr Index.